Get Tr2 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tr2 Form online

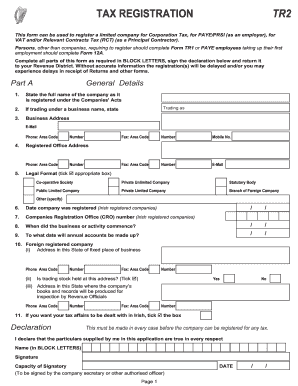

The Tr2 Form is essential for registering a limited company for various tax obligations including Corporation Tax, PAYE/PRSI, VAT, and Relevant Contracts Tax. This guide will provide you with step-by-step instructions on how to effectively complete the form online.

Follow the steps to successfully complete the Tr2 Form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete Part A, General Details, which includes the company's full registered name, business name if applicable, and business address. Provide your email, phone, and fax numbers as necessary. Ensure to fill in all details in BLOCK LETTERS.

- Indicate the legal format of your company by ticking the appropriate box (e.g., Private Limited Company, Public Limited Company). Also, specify relevant dates such as the commencement date of your business, date for annual accounts, and registration date.

- Fill in the details for directors and significant shareholders, including their full names, addresses, and PPS numbers. If you need more space, use a separate sheet.

- Proceed to Part B to register for Corporation Tax. Tick the corresponding box to confirm your registration.

- Complete Part C for VAT registration by selecting the registration date and answering specific questions regarding your business operations and financial expectations.

- If applicable, complete Part D for registration as an employer for PAYE/PRSI by indicating the number of employees and confirming payroll record systems.

- If registering as a Principal Contractor for Relevant Contracts Tax as detailed in Part E, confirm the commencement date and the number of uncertified subcontractors engaged.

- Once all sections are completed accurately, sign the declaration, ensuring that the signatory's name is printed in BLOCK LETTERS, and include the date of signing.

- Finally, save your changes, and you may choose to download, print, or share the filled form as needed.

Start filling out your Tr2 Form online today to ensure timely registration for your tax obligations.

The T2 form is often confused with the TR2 form, but they serve different purposes. While the TR2 form deals with property transactions, the T2 form typically pertains to tax reporting. Understanding the differences between these forms is crucial for compliance in legal and financial matters. If you need help navigating these forms, consider using US Legal Forms for reliable resources.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.