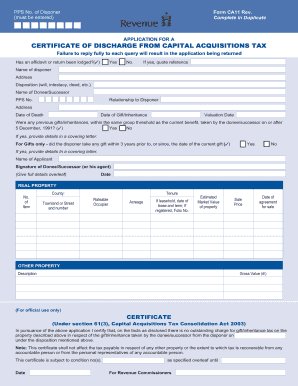

Get Ca11- Certificate Of Discharge From Capital Acquisitions Tax. Application For A Certificate Of

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA11- Certificate Of Discharge From Capital Acquisitions Tax application online

The CA11 form is essential for individuals seeking a Certificate of Discharge from Capital Acquisitions Tax. This guide provides clear, step-by-step instructions to help you accurately complete the form online, ensuring a smooth application process.

Follow the steps to successfully complete the CA11 form online.

- Click the ‘Get Form’ button to access the CA11 form and open it in your document editor.

- Begin by entering the PPS number of the disponer. This number is essential for identification purposes.

- Indicate whether an affidavit or return has been lodged by selecting 'Yes' or 'No' and provide the relevant reference if applicable.

- Fill in the 'Name of disponer' and their 'Address.' This information identifies the person granting the gift or inheritance.

- Specify the type of disposition (e.g., will, intestacy, deed) and the name of the donee or successor receiving the benefit.

- Provide the 'Relationship to disponer' and the 'Address' of the donee or successor.

- Enter the 'Date of Death' of the disponer and the 'Date of Gift/Inheritance.'

- Complete the 'Valuation Date' to establish the value of the property at the time of the gift or inheritance.

- Answer whether any previous gifts or inheritances have been taken by the donee/successor since December 5, 1991. If 'Yes,' provide details in a covering letter.

- For gifts, indicate whether the disponer took any gifts within three years prior to or since the current gift. If 'Yes,' provide details in a covering letter.

- Enter the 'Name of Applicant' and have the donee/successor or their agent sign the form.

- Fill in the 'Date' you are completing the application.

- Provide details of real property including 'County,' 'Townland or Street and number,' 'Tenure,' 'Rateable Occupier,' and 'Acreage.'

- If property is leasehold, state the 'Date of lease and term' and, if registered, include the 'Folio No.'

- Indicate the 'Estimated Market Value of property' and 'Sale Price' if applicable.

- Record the 'Date of agreement for sale' if relevant.

- For other property, include a 'Description' and 'Gross Value.'

- Review all completed information for accuracy before submission. You can then save changes, download, print, or share the completed form.

Complete your CA11 form online to apply for your Certificate of Discharge today.

To avoid Irish capital acquisitions tax, you can explore various exemptions and reliefs available under the tax laws. This may include considering the thresholds for gifts and inheritances, as well as utilizing exemptions for specific assets. Additionally, planning your estate strategically can help minimize tax liabilities. For comprehensive guidance, consider using USLegalForms to navigate through the process of acquiring a CA11- Certificate Of Discharge From Capital Acquisitions Tax. Application For A Certificate Of, ensuring compliance and potentially reducing tax exposure.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.