Loading

Get Explanatory Notes On Completion Of Form Ct1 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Explanatory Notes On Completion Of Form CT1 2012 online

Filling out the Explanatory Notes On Completion Of Form CT1 2012 online is a crucial task for companies submitting their tax returns. This guide aims to provide clear, step-by-step instructions to assist users in completing the form accurately and efficiently.

Follow the steps to complete the Explanatory Notes On Completion Of Form CT1 2012 online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

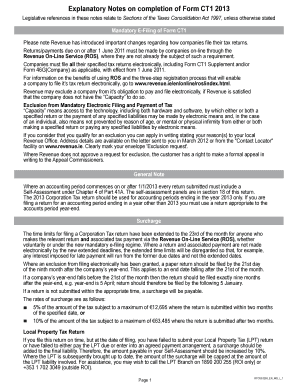

- Review the general note section, which outlines important filing deadlines and self-assessment requirements for the 2013 Corporation Tax return.

- In Panel 1 - Company Details, enter your company's specific information including cessation details, residency details, and information about associated companies.

- Proceed to Panel 2 - Trading Results, where you will record taxable profits. Be sure to separate trade profits from exempt profits.

- Complete any relevant sections regarding rental income, foreign income, and capital gains in the corresponding panels.

- Fill out Panel 9 for Deductions, Reliefs, and Credits, ensuring you accurately report any group relief and deductions being claimed.

- If applicable, document any claims for Research & Development Credits in Panel 10.

- Conclude by reviewing all entered information for accuracy before saving, downloading, or printing the completed form.

- Once the form is finalized, you can save the changes, download, print, or share the document as needed.

Complete your Explanatory Notes On Completion Of Form CT1 2012 online today for a smooth filing process.

To file itr1 step by step, begin by collecting your income documents, such as salary slips and bank statements. Next, fill out the form carefully, ensuring all information is accurate. Finally, submit the form either online or via mail. For additional help, refer to the Explanatory Notes On Completion Of Form Ct1 2012, which can provide clarity on the process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.