Loading

Get It31 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It31 Form online

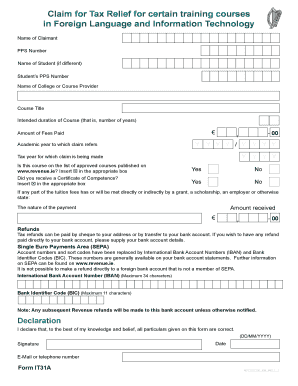

The It31 Form is used to claim tax relief for certain training courses in foreign language and information technology. This guide will provide you with a detailed, step-by-step approach to effectively complete the form online, ensuring you have all necessary information at your fingertips.

Follow the steps to complete the It31 Form online.

- Press the ‘Get Form’ button to obtain the It31 Form and open it in your preferred document editor.

- Enter the name of the claimant in the designated field. Ensure that this matches your official identification.

- Input your PPS number accurately into the corresponding field.

- If applicable, provide the name of the student if it differs from the claimant, followed by the student's PPS number.

- Fill in the name of the college or course provider that offered the training course.

- Specify the course title for which you are claiming tax relief.

- Indicate the intended duration of the course in terms of years.

- Input the total amount of fees paid for the course in euros.

- Select the academic year to which the claim refers by marking the appropriate choice.

- Identify the tax year for which the claim is being made by selecting the corresponding option.

- Mark ‘T’ in the box to indicate whether the course is approved by FÁS.

- Respond to the question about whether you received a Certificate of Competence by marking ‘T’ in the appropriate box.

- If any part of the fees is funded by grants or scholarships, provide details about the amount received and the nature of the payment.

- Complete your bank account details if you wish to receive refunds directly into your bank account. Include your IBAN and BIC.

- Review the declaration statement, confirming that all information is correct. Date the form in the specified format and provide your signature.

- Finally, provide your email or telephone number in the designated field for contact purposes.

- After ensuring all information is accurate, you can save changes, download, print, or share your completed It31 Form.

Complete your It31 Form online today for a smooth filing experience.

To receive a 1098 form, ensure that your lender or educational institution has your correct contact information. They typically send out these forms by mail or provide them through their online account systems. If you have not received yours, check with the issuer directly, and utilize the It31 Form to understand the process better.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.