Get Indiana Iolta Program Opt-out Form - Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Indiana IOLTA Program Opt-Out Form online

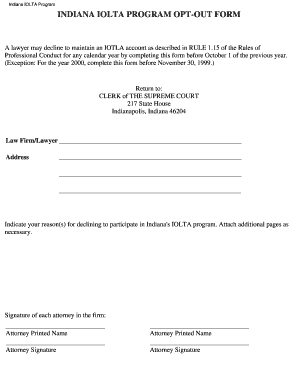

Completing the Indiana IOLTA Program Opt-Out Form is essential for lawyers who choose not to maintain an IOLTA account for a particular calendar year. This guide provides clear, step-by-step instructions to help users fill out the form accurately and efficiently.

Follow the steps to complete your Indiana IOLTA Program Opt-Out Form

- Press the ‘Get Form’ button to access the Indiana IOLTA Program Opt-Out Form and open it for editing.

- In the first section of the form, provide the law firm's name or your personal name as the lawyer. Make sure all details are accurately entered.

- In the address section, fill in your complete address, including street address, city, state, and zip code. Ensure there are no errors.

- Next, indicate your reason(s) for opting out of the Indiana IOLTA program. If your explanation requires additional space, attach separate pages as needed.

- Each attorney in the firm must provide their printed name and signature in the designated areas. Make sure all signatures are clear and legible.

- Once you have completed all sections of the form, you may save your changes, download a copy, print the form, or share it as needed.

Start filling out your Indiana IOLTA Program Opt-Out Form online now.

When an attorney passes away, the IOLTA account typically becomes part of the estate and should be managed according to legal procedures. The funds within the account must be properly disbursed to clients or the rightful heirs as determined by law. If you need to understand how to manage this situation, our resources include the Indiana IOLTA Program Opt-Out Form - Forms to assist with transitions during such circumstances.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.