Loading

Get Form 4506-a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4506-A online

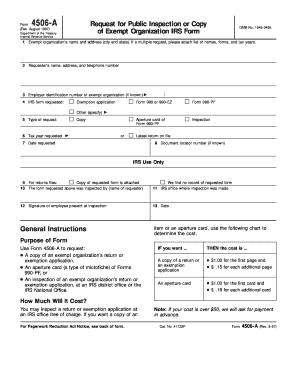

Form 4506-A allows users to request public inspection or a copy of exempt organization IRS forms. This guide provides clear, step-by-step instructions to assist you in completing the form online effectively.

Follow the steps to fill out Form 4506-A online.

- Press the ‘Get Form’ button to obtain the form and open it in the online editor.

- In line 1, provide the official name and address of the exempt organization. Accurate information is crucial for locating the requested document.

- Enter your name, address, and telephone number in line 2 for identification purposes.

- If known, enter the employer identification number of the exempt organization in line 3.

- In line 4, select the type of IRS form you are requesting: exemption application, copy of Form 990, 990-EZ, or 990-PF, or specify another form as needed.

- For line 5, indicate the type of request you are making: inspection or copy.

- Specify the tax year for the requested forms in line 6. If you prefer the latest return on file, check the appropriate box.

- Enter the requested date in line 7 to specify when you wish to access the document.

- If you have a document locator number, include it in line 8.

- Continue to fill out any additional required lines, including IRS use only fields, until all relevant information is provided.

- After reviewing all entered information for accuracy, proceed to save your changes, download, or print the completed form for submission.

Complete your documents online confidently and accurately.

Currently, Form 4506 cannot be filed electronically. You must print the completed form and send it via mail to the IRS. Staying updated on IRS policies is crucial, as regulations may change in the future. Consider using US Legal Forms to help you prepare your Form 4506 correctly before mailing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.