Get Decedent Refund Claim Rf-9 (rev. 9-09). Miscellaneous Forms

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Decedent Refund Claim RF-9 (Rev. 9-09) online

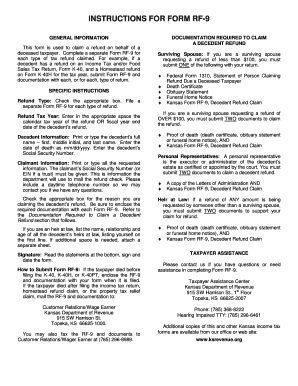

The Decedent Refund Claim RF-9 (Rev. 9-09) is used to request a refund on behalf of a deceased taxpayer. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to complete the Decedent Refund Claim RF-9 form.

- Press the ‘Get Form’ button to obtain the form and access it in the online editor.

- Identify the refund type you are claiming by checking the appropriate box. Remember to file a separate Form RF-9 for each type of refund.

- Enter the refund tax year in the designated field, indicating either the calendar tax year or the fiscal year end date relevant to the decedent’s refund.

- Provide the decedent information by printing or typing the decedent's full name, including first name, middle initial, and last name. Record the date of death in the mm/dd/yyyy format. Include the decedent’s Social Security Number.

- Fill out the claimant information by printing or typing all requested details. Ensure to include the claimant's Social Security Number or EIN if it's a trust. Also, provide a daytime telephone number for potential contact.

- Check the appropriate box indicating the reason for claiming the decedent’s refund. Make sure to attach the required documentation with each Form RF-9, as specified in the instructions.

- If applicable, list the name, relationship, and age of all the decedent’s heirs at law, placing yourself as the first entry. Use an additional sheet if more space is necessary.

- Read the statements at the bottom of the form, then sign and date the document.

- To submit Form RF-9, follow the appropriate submission instructions based on when the decedent died in relation to tax filings. Enclose all forms and documentation when mailing to the Kansas Department of Revenue or faxing as instructed.

- Lastly, you can save your changes, download, print, or share the completed form as needed.

Start completing the Decedent Refund Claim RF-9 online today to ensure a smooth refund process.

Filling out a tax return for a deceased person requires the same attention to detail as a regular return. You will need to use the Decedent Refund Claim RF-9 (Rev. 9-09). Miscellaneous Forms to report any income the deceased earned before passing. Ensure you include the date of death and follow the specific guidelines for filing as the representative of the estate. Platforms like uslegalforms can help you navigate this process with ease.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.