Get 1065 Schedule B 1 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1065 Schedule B-1 2018 online

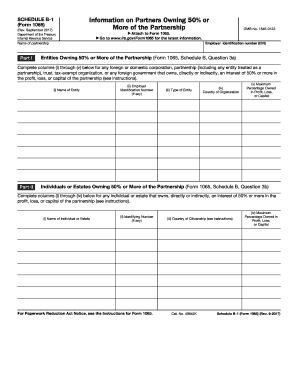

Filling out the 1065 Schedule B-1 can seem daunting, but with clear guidance, you can complete this form accurately. This document is essential for partnerships that have specific ownership structures and need to provide detailed information about partners owning a significant interest in the partnership.

Follow the steps to fill out the 1065 Schedule B-1 effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part I, where you will list entities owning 50% or more of the partnership. Enter the name of each entity in column (i), followed by the employer identification number (EIN) in column (ii), the type of entity in column (iii), the country of organization in column (iv), and the maximum percentage owned in profit, loss, or capital in column (v). Ensure that you provide details for each applicable entity.

- Next, move to Part II if your partnership answered 'Yes' to question 3b on Form 1065 Schedule B. Here, list individuals or estates owning 50% or more in the partnership. Enter the name of the individual or estate in column (i), their identifying number (like a Social Security number) in column (ii), the country of citizenship in column (iii), and the maximum percentage owned in column (iv).

- Review all entered information for accuracy. Make sure all details related to the entities and individuals are complete and correctly reflect ownership percentages.

- Once you are confident that the form is filled correctly, you can save your changes, download the completed form, and share it with your accounting team as required. Ensure you attach Schedule B-1 to Form 1065 upon final submission.

Begin completing your 1065 Schedule B-1 online today for a streamlined filing experience.

Yes, you must file Form 1065 even if your partnership has no activity for the year. The IRS requires partnerships to report their status annually, which includes filing the 1065 regardless of income or expenses. This helps maintain compliance and keeps your partnership in good standing. To navigate the filing process effectively, consider using uslegalforms to ensure your 1065 Schedule B 1 2018 is completed correctly.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.