Loading

Get Construction Loan Commitment Letter

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Construction Loan Commitment Letter online

Filling out the Construction Loan Commitment Letter online is a crucial step in securing financing for your construction project. This guide provides a clear, step-by-step approach to completing the letter accurately and effectively.

Follow the steps to complete your Construction Loan Commitment Letter online

- Click ‘Get Form’ button to access the form and open it in your preferred editor.

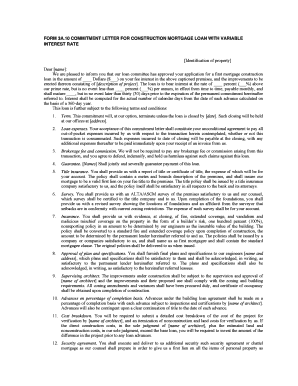

- Begin by identifying the property involved in the loan. Provide the name of the borrower and include a clear description of the premises as well as the project improvements.

- Fill in the loan amount in both written form and numerically. Specify the interest rate which will apply to the loan, ensuring you understand how this will fluctuate based on your lender's prime rate.

- Complete the maturity date for the loan. Define any relevant conditions linked to the expiration of the permanent commitment.

- Review and agree to the terms outlined in the commitment, covering items such as loan expenses, brokerage fees, guarantees, and insurance requirements.

- Input any required details regarding title insurance. Ensure you provide the necessary descriptions and obtain a title report as per the lender's specifications.

- Prepare yourself to submit various documents such as a survey report, evidence of insurances, and final plans and specifications. Each must be approved by the lender’s engineers.

- Include financial statements if required. Confirm their satisfactory status for the bank, and make sure all advances and cost breakdowns adhere to expectations established in the letter.

- Lastly, execute your acceptance of the terms by signing the letter and returning it to the bank within the specified timeframe. Consider saving changes, downloading, or printing your document for your records.

Take the next step by completing your Construction Loan Commitment Letter online today.

A construction commitment refers to the lender's agreement to finance a construction project through a Construction Loan Commitment Letter. This commitment indicates the lender's willingness to provide funds based on the project's feasibility and your creditworthiness. It is essential for securing the necessary capital to begin construction and helps you plan your project's financial aspects effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.