Loading

Get Form 27c

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 27c online

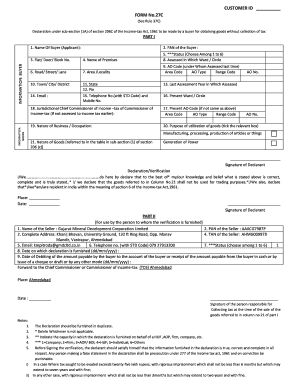

Filling out Form 27c online is a straightforward process that allows buyers to declare their intent to obtain goods without the collection of tax as per the Income-tax Act, 1961. This guide provides clear instructions to ensure you complete the form accurately and effectively.

Follow the steps to fill out Form 27c with ease.

- Click the 'Get Form' button to obtain the form and open it in the online editor.

- Begin by entering your name in the designated field for 'Name of Buyer (Applicant)'. This is crucial for identifying your declaration.

- Provide your flat, door, or block number in the corresponding field to specify your address.

- Fill in the name of your premises, along with the road, street, or lane details, and the area or locality for accurate location identification.

- Select your status from the options provided (1 to 6). This could include company, firm, or individual amongst other categories.

- Enter the ward or circle where you have been assessed by the tax authorities in the appropriate section.

- Input your PAN (Permanent Account Number) in the designated field to validate your tax identity.

- Complete your contact information, including your email address and telephone number with the STD code.

- Clearly state the nature of the business or occupation you are involved in and the purpose for which the goods will be utilized, such as manufacturing or processing.

- Sign the declaration at the end of the form, ensuring all information provided is correct and complete. Date and place should also be filled in appropriately.

- Once you have filled out all required sections, save changes, and then download or print the form for your records or to share with relevant parties.

Complete your Form 27c online today to ensure compliance and seamless transactions.

Common mistakes on CRA tax forms include incorrect personal information, math errors, and missing signatures. Not double-checking the details can lead to delays or penalties. To avoid these pitfalls, carefully review your completed Form 27C and ensure all information is accurate. Tools like USLegalForms provide resources to help you complete the form correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.