Loading

Get Cpa125

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cpa125 online

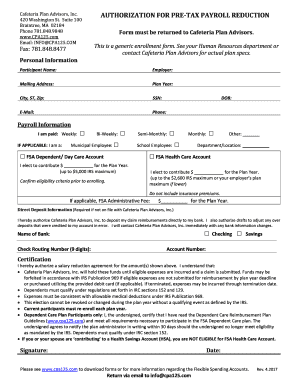

The Cpa125 form is essential for enrolling in a cafeteria plan, allowing users to manage pre-tax payroll reductions efficiently. This guide will provide clear, step-by-step instructions to help you complete the Cpa125 online with ease.

Follow the steps to successfully complete the Cpa125 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your personal information, including your name, employer, street address, city, state, zip code, Social Security Number, email, and phone number. Ensure that all entries are accurate for timely processing.

- In the payroll information section, indicate how often you are paid by selecting the corresponding option: weekly, bi-weekly, semi-monthly, monthly, or other. If applicable, identify whether you are a municipal or school employee.

- Proceed to select the benefits you wish to enroll in from the available options: FSA dependent/day care account or FSA medical/dental care account. Enter the contribution amount for each plan year, ensuring that you do not exceed the maximum limits of $5,000 for the dependent/day care account and $2,500 for the medical/dental account.

- If not already on file, provide your direct deposit information. Choose between checking or savings accounts and enter the name of your bank, routing number, and account number to facilitate claim reimbursements directly to your bank.

- Read through the certification section carefully. This section contains important information about fund usage, claim submission deadlines, and eligibility criteria. Sign and date the form to authorize the salary reduction agreement.

- Once all fields are completed and verified, save your changes. You can then download, print, or share the Cpa125 form as needed.

Complete your documents online today for a seamless experience.

Related links form

CAF 125 on your W-2 is another way to refer to contributions made under a Section 125 cafeteria plan. This designation shows the total amount deducted from your paycheck for pre-tax benefits. These deductions can reduce your taxable income, which is beneficial during tax season. Knowing what CAF 125 represents can clarify your financial records.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.