Loading

Get Non Ucc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Non Ucc online

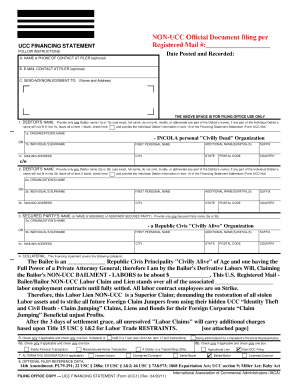

Filling out the Non Ucc form is a crucial step for those seeking to record a financing statement. This guide will provide you with clear and detailed instructions on how to complete the form accurately and efficiently.

Follow the steps to complete the Non Ucc form online.

- Click 'Get Form' button to obtain the Non Ucc form and open it in the online editor.

- In section A, you may provide the name and phone number of a contact person at the filer; this step is optional.

- Continue to section B, where you can include an email contact for the filer if desired.

- In section C, enter the name and address where you would like an acknowledgment to be sent.

- For section 1, input the debtor's name. You must choose either 1a (organization's name) or 1b (individual's surname), ensuring that the name entered is the complete and exact version. If it does not fit, leave this section blank and provide the information in item 10 of the addendum.

- Complete section 1c with the mailing address of the debtor, including first personal name, additional name(s) or initials, suffix, city, state, country, and postal code.

- Proceed to section 2 and repeat the process for the second debtor if applicable, filling out only one debtor name again, along with their mailing address.

- In section 3, indicate the secured party's name, choosing between section 3a (organization's name) or 3b (individual's surname) while ensuring the name is complete and exact.

- Input the mailing address for the secured party in section 3c, including all relevant details as previously described.

- In section 4, describe the collateral that the financing statement covers clearly and in detail.

- In section 5, check the box only if the collateral is held in a trust, referring to the addendum if necessary.

- Section 6 requires you to check applicable boxes for specific transaction types.

- For section 7, fill out the alternative designation if applicable.

- Section 8 allows for optional filer reference data. This is not required but can be useful for your records.

- After reviewing all entries for accuracy, proceed to save your changes, download a copy, print, or share the completed form as needed.

Start your Non Ucc document filing online today for a smooth and efficient process.

Non-UCC refers to transactions and filings that do not fall under the Uniform Commercial Code. This can include various agreements, contracts, and legal documents that are not governed by UCC provisions. Knowing about non-UCC is important for individuals and businesses alike, as it impacts how they handle specific legal matters. At US Legal Forms, we offer resources to help you navigate non-UCC filings effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.