Loading

Get Pmt 03 Declaration Format

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pmt 03 Declaration Format online

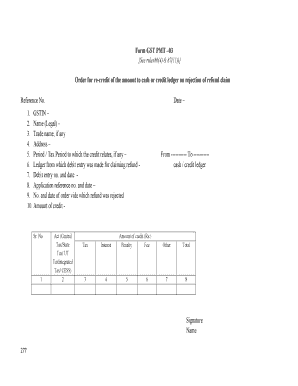

The Pmt 03 Declaration Format is essential for users seeking re-credit of amounts to their cash or credit ledger following the rejection of a refund claim. This guide provides a step-by-step process to assist you in accurately completing this form online.

Follow the steps to complete the Pmt 03 Declaration Format.

- Press the ‘Get Form’ button to access the form, which will open in your selected editor.

- In the first field, enter your GSTIN, which is your Goods and Services Tax Identification Number, ensuring it is accurate.

- In the next line, input your legal name as registered, followed by your trade name if you have one.

- Fill in your complete address in the designated section to ensure proper identification.

- Specify the period or tax period related to the credit. This detail is important for referencing your case.

- Indicate the ledger from which the debit entry was made to claim the refund.

- Provide the debit entry number and the date associated with the entry.

- Enter the application reference number along with the corresponding date.

- Input the number and date of the order through which the refund claim was rejected.

- State the amount of credit being claimed in the required section.

- For each tax component (Central Tax, State Tax, UT Tax, Integrated Tax, CESS), input the specific amounts under separate sections for tax, interest, penalty, fee, and any other relevant details.

- Ensure the total amount is calculated accurately and entered in the final section.

- After filling all sections, provide your signature, name, and designation of the officer if applicable.

- Once you have completed the form, make sure to save your changes and download, print, or share the form as needed.

Complete your forms online quickly and efficiently to ensure timely processing.

Filling a non-GST declaration form requires you to clearly state the purpose and relevant information about the transaction. Make sure to follow any specific guidelines provided in the PMT 03 Declaration Format if applicable. Organizing your data beforehand can simplify the process. USLegalForms offers templates that can assist you in this task, ensuring you meet all necessary requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.