Loading

Get Pva Wien

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Pva Wien online

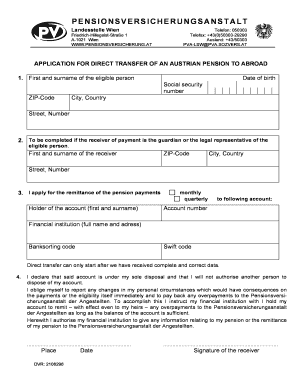

Filling out the Pva Wien form for direct transfer of an Austrian pension to abroad can be straightforward if you follow the right steps. This guide provides detailed instructions to help you complete each section of the form accurately and efficiently.

Follow the steps to complete your application online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the first section, enter the first and surname of the eligible person, followed by their date of birth, social security number, ZIP code, city, country, street, and number.

- If the receiver of the payment is not the eligible person, provide their first and surname in the designated section, along with their ZIP code, city, country, street, and number.

- In the next section, specify whether you apply for monthly or quarterly remittance of the pension payments. Include the holder of the account’s first and surname here.

- Complete the fields for the account number, financial institution (provide full name and address), bank sorting code, and SWIFT code to set up the direct transfer.

- Read and acknowledge the declaration about sole disposal of the account and the obligation to report any changes affecting the payments or eligibility.

- Sign and date the form in the designated area alongside the place of signing.

- The financial institution will need to confirm your application. Ensure they provide a signature or stamp, along with the date and place of confirmation.

Complete your Pva Wien form online for a seamless transfer process.

Related links form

Austria's retirement system comprises several pillars, including state pensions, occupational pensions, and private savings. The state pension, managed by Pva Wien, is the primary source of income for most retirees. Each pillar plays a significant role in ensuring financial security during retirement, and it's wise to explore all options available to you.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.