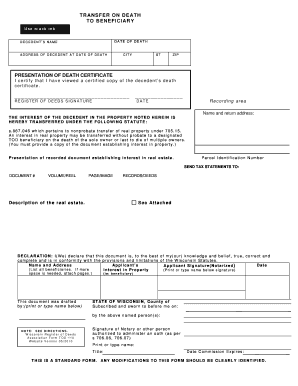

Get Transfer On Death To Beneficiary 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Transfer on Death to Beneficiary online

How to fill out and sign Transfer on Death to Beneficiary online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Are you still looking for a fast and easy way to complete Transfer on Death to Beneficiary at an affordable price?

Our service offers you a broad array of forms that can be filled out online. It takes just a few minutes.

Completing Transfer on Death to Beneficiary doesn't have to be a hassle anymore. Now you can easily handle it from your home or office using your mobile device or desktop.

- Locate the document you require in the assortment of legal forms.

- Launch the document in our web-based editing tool.

- Browse through the guidelines to identify which details you need to include.

- Select the fillable fields and enter the necessary information.

- Input the date and add your electronic signature after completing all fields.

- Review the finished form for errors and typos. If you need to make adjustments, the online editor with its extensive tools is at your disposal.

- Download the completed form to your computer by clicking Done.

- Send the digital document to the designated recipient.

How to modify Get Transfer on Death to Beneficiary 2010: personalize documents online

Take advantage of the user-friendly nature of the multi-functional online editor while completing your Get Transfer on Death to Beneficiary 2010. Utilize the range of features to swiftly fill in the gaps and submit the required information in no time.

Assembling files can be time-consuming and costly unless you have pre-prepared fillable templates that you can fill out digitally. The optimal way to tackle the Get Transfer on Death to Beneficiary 2010 is to employ our expert and versatile online editing tools. We offer all the essential features for quick document completion and allow you to modify your forms to meet various requirements. Additionally, you can comment on the modifications and leave notes for other involved parties.

Here’s what you can accomplish with your Get Transfer on Death to Beneficiary 2010 in our editor:

Utilizing the Get Transfer on Death to Beneficiary 2010 in our robust online editor is the quickest and most efficient way to handle, submit, and share your paperwork according to your preferences from any location. The tool functions from the cloud, allowing access from any device with internet connectivity. All forms you create or edit are securely saved in the cloud, ensuring you can always reach them when required and guaranteeing you won't lose them. Stop squandering time on manual document preparation and eliminate paper; accomplish everything online with minimal effort.

- Fill in the blanks using Text, Cross, Check, Initials, Date, and Sign features.

- Emphasize key details with a chosen color or underline them.

- Hide sensitive details with the Blackout feature or simply eliminate them.

- Incorporate images to illustrate your Get Transfer on Death to Beneficiary 2010.

- Substitute the original text with content that fits your requirements.

- Insert comments or sticky notes to notify others about the updates.

- Add extra fillable areas and allocate them to specific individuals.

- Secure the document with watermarks, include dates, and bates numbers.

- Distribute the document in various formats and store it on your device or in the cloud after final adjustments.

Transfer on death and beneficiary designations are related but not the same. A transfer on death to beneficiary applies particularly to real estate or personal property, allowing you to transfer ownership automatically upon your death. Conversely, beneficiary designations typically pertain to financial accounts and insurance policies, where assets go directly to the named individual. Understanding these differences can help you effectively plan your estate and achieve your legacy goals.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.