Get Deephaven Mortgage

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Deephaven Mortgage online

Filling out the Deephaven Mortgage online can seem daunting, but with clear guidance, you can navigate the process with ease. This guide will walk you through each step to ensure that your experience is smooth and efficient.

Follow the steps to complete your mortgage application effectively.

- Click ‘Get Form’ button to obtain the form and open it for completion.

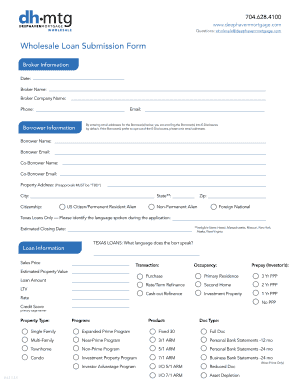

- Begin with the Broker Information section. Here, enter the date, broker name, broker company name, phone number, and email address. Ensure that all provided information is accurate and up-to-date.

- Next, move on to the Borrower Information. Fill in the names and email addresses for the borrower and co-borrower. If they prefer to opt out of E-Disclosures, omit their email addresses.

- Continue by providing the property address, city, state, and zip code. Note that for preapprovals, the property address must be ‘TBD’.

- Indicate the citizenship status of the borrower. Select from options such as US Citizen/Permanent Resident Alien, Non-Permanent Alien, or Foreign National.

- For Texas loans only, specify the language spoken during the application process.

- Fill in the estimated closing date for your loan application.

- In the Loan Information section, provide details such as sales price, estimated property value, loan amount, loan-to-value (LTV) ratio, and interest rate.

- Specify the type of occupancy—choose from options like primary residence, second home, or investment property.

- Select the relevant credit score and property type. Options may include single family, multi-family, townhome, or condo.

- Choose the mortgage program that best fits your needs and complete any required documentation as listed in the loan submission requirements section.

- Once you have completed the form, review all entries for accuracy and ensure all required fields are filled.

- Finally, save changes, download, print, or share the form as needed to complete your submission.

Take the next step in your mortgage journey by completing the Deephaven Mortgage form online today.

When speaking with a mortgage lender, avoid making statements that may raise red flags, such as indicating you plan to change jobs soon or that you have financial struggles. It's also unwise to discuss other loans you're considering or to express uncertainty about your finances. Instead, focus on providing clear and honest information about your financial situation to build trust and confidence in your application for a Deephaven Mortgage.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.