Get W4 Lansing - Wmich

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W4 Lansing - Wmich online

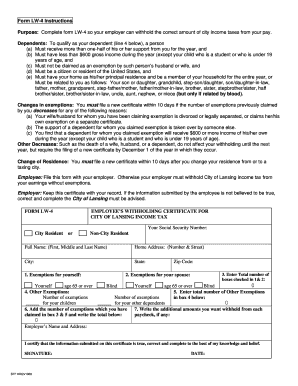

Filling out the W4 Lansing - Wmich form is essential for ensuring accurate withholding of city income taxes from your paycheck. This guide will walk you through each section of the form, providing clear instructions for users of all experience levels.

Follow the steps to complete the W4 Lansing - Wmich form online.

- Click the ‘Get Form’ button to access the W4 Lansing - Wmich form and open it in the editor.

- Enter your full name, including your first, middle, and last name, in the designated field.

- Provide your complete home address, including the number and street, city, state, and zip code.

- Indicate whether you are a city resident or non-city resident by selecting the appropriate option.

- In section 1, check the boxes for any exemptions that apply to you. This includes being age 65 or over or being blind.

- In section 2, check the boxes for exemptions that apply to your spouse, if applicable.

- Count the number of exemptions you have checked in sections 1 and 2, and enter the total in the designated box under section 3.

- In section 4, enter information regarding other exemptions for your children or other dependents.

- Add the exemptions from section 4 and write the total number of other exemptions in the corresponding box.

- Sum the total number of exemptions from sections 3 and 5 and record the total in the appropriate area.

- If you wish to have additional amounts withheld from each paycheck, specify that amount in the designated field.

- Review all the information for accuracy, then provide your signature and date at the bottom of the form.

- Save your changes, and then you can download, print, or share the completed form as needed.

Complete your documents online to ensure a smooth process and accurate tax withholding.

Filling out the CF W-4 correctly is crucial for accurate tax withholding. Start by providing your personal information, including your name and Social Security number. Next, determine your filing status and number of allowances, which will influence how much tax is withheld from your paycheck. If you need help navigating this process, USLegalForms offers helpful templates and guidance tailored to the W4 Lansing - Wmich form.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.