Loading

Get Umass W 9 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Umass W 9 Form online

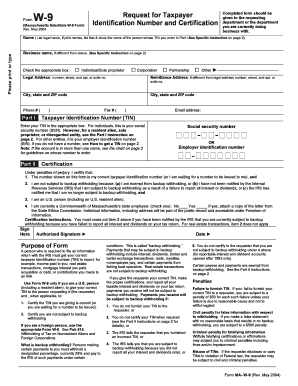

The Umass W 9 Form is essential for individuals and businesses to provide their taxpayer identification number (TIN) for reporting purposes. This guide will walk you through the process of filling out the form online, ensuring that you complete it accurately and efficiently.

Follow the steps to complete the Umass W 9 Form online.

- Press the ‘Get Form’ button to obtain the Umass W 9 Form and open it in the online editor.

- Enter your legal name in the designated field. For individuals, this is generally the name shown on your social security card. If you are submitting for a joint account, list the first name and circle the person whose TIN will be entered in Part I.

- If applicable, input your business name on the line provided if it differs from your legal name.

- Select the appropriate box to indicate your classification: Individual/Sole proprietor, Corporation, Partnership, or Other.

- Fill in your remittance address and legal address, ensuring to include the city, state, and ZIP code.

- Provide your taxpayer identification number (TIN) in Part I. If you are an individual, this will be your social security number (SSN). For other entities, you will need to provide your employer identification number (EIN). If you do not have a number, refer to the instructions on how to obtain one.

- In Part II, provide your email address along with your SSN or EIN.

- Review the certification section. You must certify that the TIN you provided is accurate, that you are not subject to backup withholding, and that you are a U.S. person or resident alien.

- Sign and date the form at the designated area. Make sure that the person whose TIN is shown is the one signing the form if it's a joint account.

- Once you've completed all sections of the form, you can save your changes, download, print, or share the form as necessary.

Start filling out your Umass W 9 Form online today to ensure your taxpayer information is accurately reported.

Yes, you should fill out your own Umass W 9 Form to ensure the information accurately reflects your tax situation. It is important for you to take responsibility for the details provided. Doing so helps maintain accurate records for both you and the requester.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.