Loading

Get Taxescagovde4xls Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Taxescagovde4xls Form online

Filling out the Taxescagovde4xls Form is essential for accurately managing your state income tax withholding. This guide will provide you with a clear, step-by-step process to complete this form online, ensuring you meet your tax obligations effectively.

Follow the steps to complete the Taxescagovde4xls Form online:

- Click ‘Get Form’ button to obtain the Taxescagovde4xls Form and open it in your preferred spreadsheet application.

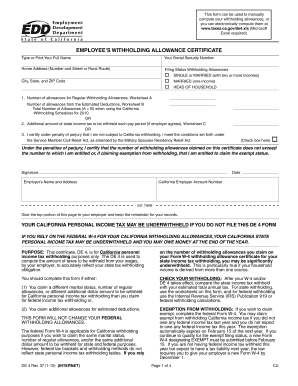

- Enter your full name in the designated field labeled 'Type or Print Your Full Name'.

- Provide your Social Security Number in the appropriate section. Ensure this is accurate to avoid potential issues.

- Fill in your home address, including the number and street or rural route, and complete the city, state, and ZIP code fields.

- Select your filing status and the corresponding withholding allowances: 'Single or Married (with two or more incomes)', 'Married (one income)', or 'Head of Household'.

- Calculate the number of regular withholding allowances you are eligible for and enter this number in the respective fields. Use Worksheet A for the allowances and Worksheet B for estimated deductions if applicable.

- If you wish to withhold an additional amount of state income tax per paycheck, state this amount in the designated field, referencing Worksheet C if necessary.

- If applicable, check the box to certify that you are exempt from California withholding under the specified conditions.

- Sign and date the form at the bottom to confirm that the information provided is truthful and valid.

- Submit the top portion of the completed form to your employer and retain the remainder for your records. Consider steps to save changes, download, print, or share the form as needed.

Now that you have a complete understanding, proceed to fill out the Taxescagovde4xls Form online.

Yes, you can file your tax return by yourself, especially if you feel comfortable with the process. Many resources, including online platforms like uslegalforms, simplify tax filing. Make sure to gather all necessary documents, including your W4 and any income statements. Using the Taxescagovde4xls Form can provide you with clear instructions for a successful filing experience.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.