Loading

Get Extension Of Time Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Extension Of Time Form online

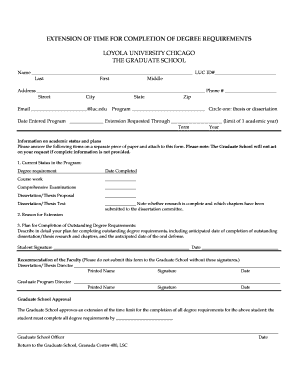

This guide provides a clear and comprehensive overview of how to accurately fill out the Extension Of Time Form for completion of degree requirements at Loyola University Chicago. Follow these steps to ensure your request is submitted correctly and efficiently.

Follow the steps to complete the Extension Of Time Form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your personal information in the designated fields, including your name, LUC ID number, address, phone number, email, and academic program choice (thesis or dissertation). Ensure all fields are completed accurately.

- Indicate the date you entered the program by entering the date in the specified field.

- Select the term and year for which you are requesting the extension by filling in the appropriate fields.

- Attach a separate piece of paper containing information on your current status in the program. Include details such as completed coursework, comprehensive examinations, and the current status of your dissertation/thesis proposal and text.

- Provide the reason for your extension request, clearly explaining your circumstances in the specified section.

- Outline your plan for completing outstanding degree requirements. Be thorough and include anticipated completion dates for your dissertation/thesis research, chapters, and oral defense.

- Ensure you sign and date the form in the student signature section.

- Have your dissertation/thesis director and graduate program director review and sign the form in their respective sections.

- Once all necessary signatures are obtained, review the form for completeness and accuracy before submitting.

- After final checks, you can save changes, download, print, or share the completed form as required.

Start filling out your Extension Of Time Form online today for a smooth submission process.

Related links form

Form 4868 and Form 7004 both allow taxpayers to request an extension for filing their respective tax returns, but they cater to different audiences. Form 4868 is for individuals, whereas Form 7004 is for businesses and corporations. By understanding which Extension Of Time Form to use, you can avoid unnecessary penalties and prepare your taxes with confidence.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.