Loading

Get Appendix 8a Form 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Appendix 8a Form 2015 online

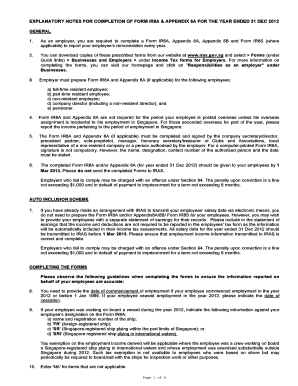

Completing the Appendix 8a Form 2015 online is an essential task for employers reporting employee remuneration. This guide provides a clear and comprehensive approach to filling out each section of the form, ensuring accurate reporting and compliance with regulations.

Follow the steps to complete the Appendix 8a Form 2015 online.

- Click ‘Get Form’ button to obtain the Appendix 8a Form 2015 and open it in your preferred editor.

- Begin by entering the date of commencement of employment for employees who started in 2012 or before. If an employee ceased employment in 2012, indicate the cessation date.

- If applicable, provide details for employees working on board a vessel, including the name and registration number of the ship and indicate if it is foreign-registered (FR) or Singapore-registered (SR).

- Report all income, including gross salary, bonuses, and director’s fees, ensuring that you report amounts due for 2012, regardless of when they were paid.

- Provide details of any benefits-in-kind that need to be declared, making sure to value the place of residence or applicable benefits correctly.

- If there are corrections after submission, complete a new form with the correct details, marking it as ‘AMENDED’ or ‘ADDITIONAL’.

- Finalize the form by saving your changes. You can then download, print, or share the completed Appendix 8a Form 2015.

Begin filling out your documents online today!

To obtain the ITR (Income Tax Return) form, head over to the IRS website, which provides all necessary tax documents. You may also contact a tax advisor who can assist you in finding the correct form. For added convenience, uslegalforms offers a one-stop resource for securing not only the ITR but also related documents you may need.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.