Loading

Get Nyc Tc600 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nyc Tc600 Form online

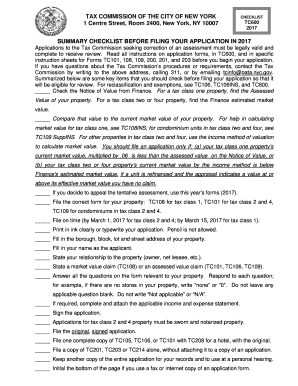

The Nyc Tc600 Form is essential for individuals seeking correction of property tax assessments in New York City. This guide will provide you with clear, step-by-step instructions on how to fill out the form online, ensuring that your application is complete and legally valid.

Follow the steps to fill out the Nyc Tc600 Form online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Ensure you read all accompanying instructions related to the TC600 form as well as those for other relevant forms before you begin.

- Enter the borough, block, lot, and street address of your property clearly in the appropriate fields.

- Fill in your name as the applicant, ensuring it is typed clearly.

- State your relationship to the property, such as owner or net lessee.

- Provide either a market value claim or assessed value claim according to what is applicable to your property.

- Answer all questions related to your property accurately and fully; do not leave any applicable question blank.

- If necessary, complete and attach the income and expense statement that applies to your situation.

- Ensure you sign the application where indicated.

- Remember that if your property falls under tax class 2 or 4, the application must be sworn and notarized appropriately.

- Submit the original, signed application form.

- Keep a copy of the entire application for your records, and to use at a personal hearing.

- If you are using a fax or internet version of the application form, initial the bottom of the page.

Take the next step in managing your property tax assessment by completing the Nyc Tc600 Form online today.

The best evidence to protest property taxes includes recent comparable sales, property appraisals, and documented discrepancies in property records. Collect data showcasing fair market values and ensure that your documentation is clear and well-organized. Utilizing the NYC TC600 Form to present this evidence will help convey your argument to the authorities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.