Get Ct 399

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ct 399 online

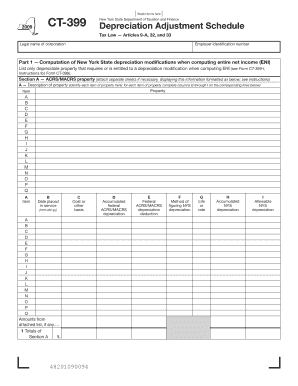

The Ct 399 form, also known as the Depreciation Adjustment Schedule, is essential for corporations in New York to report depreciation modifications when computing entire net income. This guide provides step-by-step instructions to help users fill out the form accurately and efficiently online.

Follow the steps to fill out the Ct 399 online.

- Press the ‘Get Form’ button to access the form and open it in the necessary editor for editing.

- Begin with Part 1, where you will list only depreciable property that requires or is entitled to a depreciation modification when computing entire net income (ENI). For each item of property, identify it and complete the relevant columns (B through I) accordingly.

- In Section A, fill in all required details, such as the description of the property, date placed in service, cost or other basis, federal depreciation details, and New York State depreciation methods. Attach additional sheets if necessary.

- Proceed to Section B for 30%/50% federal special depreciation property. Similar to Section A, provide a description and fill out the corresponding columns for each item listed.

- Follow up with Part 2 to complete disposition adjustments by evaluating the difference between federal and New York State depreciation deductions for each property, and enter any adjustments calculated in columns E and F.

- Complete Part 3 by summarizing adjustments to ENI, inputting totals for both federal and New York State columns as appropriate.

- Conclude with Part 4 if necessary, providing depreciation adjustments specifically for Article 9-A and verifying if the properties listed were put in service after 1986.

- Once all sections are properly filled, users can save changes, download, print, or share the completed form as needed.

Start completing the Ct 399 online today to ensure accurate reporting of your depreciation adjustments.

You can claim depreciation using IRS Form Ct 399, which allows you to report the loss in value of your assets over time. First, evaluate the assets eligible for depreciation and then gather the necessary documentation. It's crucial to calculate the depreciation correctly to maximize your benefits. This approach helps you reduce your taxable income effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.