Get Form Ss-8 - North Carolina Office Of The State Controller - Osc Nc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form SS-8 - North Carolina Office Of The State Controller - Osc Nc online

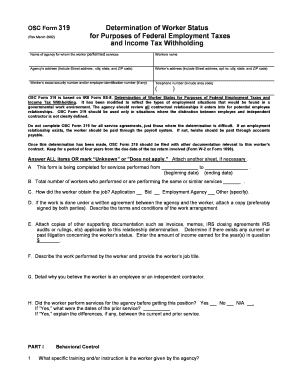

Filling out Form SS-8 is essential for determining worker status for federal employment taxes and income tax withholding purposes. This guide provides a clear, step-by-step approach to assist users in completing the form accurately in an online format.

Follow the steps to complete the Form SS-8 online.

- Press the ‘Get Form’ button to access and open the form in the online editor.

- Begin by entering the name of the agency for which the worker performed services in the designated field.

- Fill in the worker's name as it appears on official documents.

- Provide the agency's complete address, including street address, city, state, and ZIP code.

- Input the worker's address, ensuring it includes the street address, apartment number (if applicable), city, state, and ZIP code.

- Enter the worker's social security number and/or employer identification number if available.

- Include the worker's telephone number, including the area code.

- Specify the service performing period by filling in the beginning and ending dates.

- Indicate the total number of workers performing the same or similar services.

- Describe how the worker obtained the job, choosing from the provided options or specifying another method.

- If a written agreement exists, attach a copy and describe the terms and conditions of the work arrangement.

- Provide supporting documentation such as invoices and memos to assist in the relationship determination.

- Detail the work performed and the worker's job title in the corresponding sections.

- Describe why you believe the worker is classified as an employee or independent contractor.

- Answer the questions regarding previous services performed for the agency and detail any differences from current services.

- Complete all remaining sections on behavioral and financial control, relationship with the agency, and worker's benefits.

- Review the form for accuracy and completeness before submitting or saving it.

- After completing the form, you can save changes, download, print, or share the document as needed.

Complete your Form SS-8 online to ensure accurate determination of worker status.

To report misclassification, you can submit Form 3949-A to the IRS, detailing your concerns about worker classification. It is essential to include as much information as possible to support your claim. Additionally, you may consult the Form SS-8 - North Carolina Office Of The State Controller - Osc Nc to guide you through this process. Taking action ensures that you and others are treated fairly under the tax laws.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.