Loading

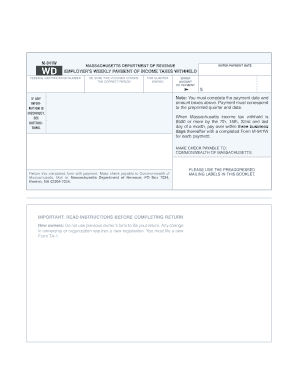

Get Ma Form M 941 W

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ma Form M 941 W online

Filling out the Ma Form M 941 W online can streamline the process of reporting income tax withheld. This guide will provide clear and concise instructions to help you navigate each step effectively.

Follow the steps to complete the Ma Form M 941 W online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing interface.

- Enter the payment date in the designated box. Ensure this date corresponds to the correct period indicated on the form.

- Locate the field for your Federal Identification Number and input it accurately. This number is essential for identifying your business.

- Select the quarter ending date by confirming it aligns with the period for which you are filing the payment.

- Fill in the amount of payment in the specified box. This amount should reflect the taxes withheld as required.

- Review all entered information for accuracy. If you identify any errors, refer to the accompanying instructions for corrections.

- Once completed, you may save your changes, download the form, print it for submission, or share it as needed.

Take action now and complete your Ma Form M 941 W online to ensure timely filing.

The number of exemptions you can claim in Massachusetts depends on your personal situation, including your family size and dependents. Generally, you can claim one exemption for yourself and additional exemptions for your spouse and qualifying children. It's essential to strike a balance between claiming enough exemptions to reduce your tax burden while ensuring you won’t owe taxes at the year's end. For guidance, consider using tools available on US Legal Forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.