Loading

Get M 941d Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the M 941d Form online

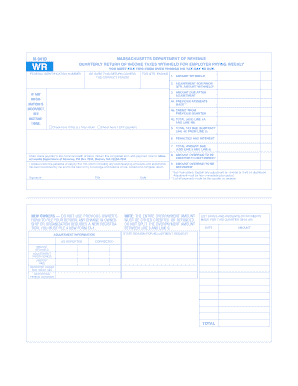

The M 941d Form is a crucial document for reporting income taxes withheld by employers who pay weekly. This guide will provide you with step-by-step instructions on how to fill out the form online, ensuring compliance and accuracy in your submission.

Follow the steps to fill out the M 941d Form online effectively

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your federal identification number in the designated field to link the form to your business.

- Ensure the return covers the correct period for the quarter ending you are reporting on.

- In the first section, enter the amount withheld during the current quarter.

- If there were any adjustments from prior quarters, note those in the second section and ensure accurate reporting.

- Calculate the amount due after any adjustments and record it in the third section.

- In lines 4A and 4B, input previous payments made and any credit from the previous quarter, respectively.

- Add lines 4A and 4B together in line 4C for total credits.

- Subtract line 4C from line 3 to calculate the total tax due; place this figure in line 5.

- If applicable, include any penalties and interest in line 6.

- Add line 5 and line 6 for the total amount due in line 7.

- Indicate if this is a final return or if you are making an Electronic Funds Transfer (EFT) payment.

- For any overpayment, decide whether to credit to the next period (line 8) or request a refund (line 9), but remember not to split the overpayment between these two options.

- Provide your signature and title at the bottom of the form to certify that the information is accurate.

- Once completed, save your changes, then download, print, or share the form as necessary.

Start filling out the M 941d Form online today to ensure timely and accurate reporting.

To obtain a business 941 transcript from the IRS, you can request it online using the IRS portal or by submitting Form 4506-T. This process enables you to access your payroll tax history, including details from the M 941d Form. Accurate transcripts can assist with financial planning and tax preparation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.