Loading

Get Ptax 329 Form Whiteside County

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ptax 329 form Whiteside County online

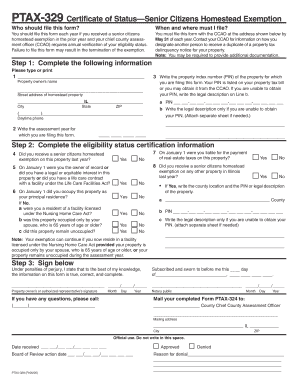

Filling out the Ptax 329 form is essential for verifying your eligibility for the senior citizens homestead exemption in Whiteside County. This guide provides you with clear and supportive instructions to navigate the process online with ease.

Follow the steps to complete your Ptax 329 form online.

- Click ‘Get Form’ button to obtain the form and open it in your chosen editor.

- Complete the following information. Please type or print your answers clearly: 1. Provide the property owner’s name. 2. Write the property index number (PIN) of the property for which you are filing the form. The PIN is listed on your property tax bill or can be obtained from the chief county assessment officer (CCAO). If you cannot obtain the PIN, provide the legal description instead. 3. Write the street address of the homestead property, including the city and ZIP code. 4. Include your daytime phone number. 5. Enter the assessment year for which you are filing this form.

- Complete the eligibility status certification information: 6. Indicate whether you received the senior citizens homestead exemption on this property last year (Yes/No). 7. State if you were liable for the payment of real estate taxes on this property as of January 1 (Yes/No). 8. Confirm if you received the exemption on any other property in Illinois last year (Yes/No). 9. State if you occupied this property as your principal residence on January 1. If No, answer the following sub-questions regarding residency status. 10. If applicable, write the location and PIN or legal description of any other relevant property.

- Sign and date the form: 11. Under penalties of perjury, confirm that the information provided is true, correct, and complete. 12. Provide your signature and the date, as well as the signature of a notary public if required.

Ensure your senior citizens homestead exemption remains intact by completing your Ptax 329 form online today.

Property taxes may decrease when you turn 65 if you qualify for certain exemptions provided by the state of Illinois. Seniors can access programs that reduce their property’s assessed value, lessening the taxes owed. To ensure you receive the appropriate benefits, complete necessary paperwork, including the Ptax 329 Form Whiteside County. This strategic step can lead to noteworthy tax relief.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.