Loading

Get Form 4 990

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4 990 online

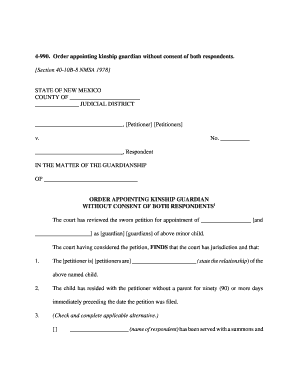

Filling out the Form 4 990 online can be a straightforward process when you understand the components and requirements of the form. This guide provides a clear and supportive approach to help you navigate each section effectively.

Follow the steps to complete the Form 4 990 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the appropriate jurisdiction in the provided field, such as the county and judicial district associated with your case.

- In the section for petitioners, input the names of the individuals seeking guardianship and their relationship to the minor child.

- Indicate the minor child's name and confirm that they have lived with the petitioner for the required time frame without a parent.

- Choose the applicable options regarding the respondent's service of the summons and petition, marking the relevant conditions met.

- Specify if either parent has consented to the appointment of the guardian and whether their consent is filed with the court.

- If applicable, complete the child support and visitation agreements, providing any necessary details.

- Review all entered information for accuracy and completeness, making sure each section is filled correctly before submitting.

- Once all information is verified, save your changes, and proceed to download, print, or share the completed form as necessary.

Start filling out your documents online today.

Organizations that are registered as tax-exempt under IRS rules are usually required to file Form 990. This includes public charities, private foundations, and other nonprofits with sufficient revenue. Understanding your organization's classification will ensure you meet necessary filing deadlines, as missing these can impact your tax-exempt status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.