Loading

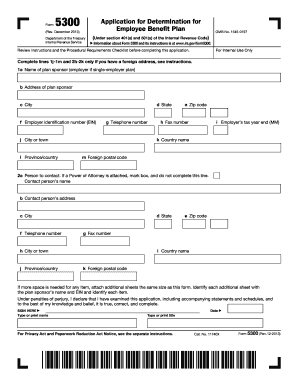

Get Revenue Procedure 2008 6 619 Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Revenue Procedure 2008 6 619 Form online

This guide provides clear and detailed instructions on how to complete the Revenue Procedure 2008 6 619 Form online. With step-by-step guidance tailored for users with varying levels of experience, you will navigate through each section effectively.

Follow the steps to fill out the Revenue Procedure 2008 6 619 Form online.

- Press the ‘Get Form’ button to access the form and view it in the editor.

- Begin by entering the name of the plan sponsor in the designated field. Ensure you provide accurate and complete information as it is essential for identification.

- Fill in the address of the plan sponsor, including city, state, and zip code. This information is critical for processing and correspondence.

- Input the employer identification number (EIN) and the telephone number of the plan sponsor. This is necessary for tax identification.

- In section 2, provide the contact person's details if not represented by a Power of Attorney. Include name, address, and contact information.

- Section 3 requests information on the determination requested. Select the appropriate option for qualification status and provide related dates as required.

- As you complete sections 4-6, ensure you select the type of plan and provide relevant descriptions and dates to describe the plan's structure and compliance.

- Continue assembling information about amendments and any discretionary provisions under line 3m and mark as applicable.

- Review the Procedural Requirements Checklist provided at the end of the form to ensure all required documents and statements are included.

- Once completed, you can save your changes, download, print, or share the form as necessary.

Start filling out your Revenue Procedure 2008 6 619 Form online today to ensure timely compliance.

Yes, you can conduct a 1031 exchange yourself; however, it requires thorough understanding and compliance with IRS rules. This process involves carefully following the guidelines in the Revenue Procedure 2008 6 619 Form to avoid pitfalls. Although it is possible to do it on your own, many choose to work with professionals to ensure compliance and maximize tax benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.