Loading

Get Payroll Distribution

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Payroll Distribution online

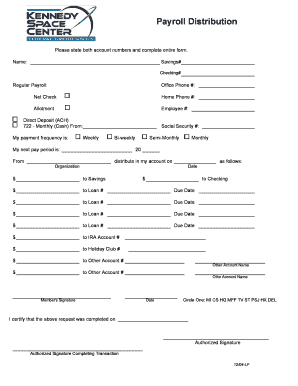

Filling out the Payroll Distribution form is an essential process for directing your earnings into various accounts. This guide aims to provide a clear and supportive path to successfully complete the form online.

Follow the steps to effectively complete the Payroll Distribution form

- Click ‘Get Form’ button to access the Payroll Distribution document and open it in the online editor.

- Begin by entering your name at the top of the form to identify yourself. Ensure that you fill in both savings and checking account numbers in the corresponding fields.

- Specify your preferred payment frequency by selecting one of the available options: Weekly, Bi-weekly, Semi-Monthly, or Monthly.

- Indicate your employee number and provide the office and home phone numbers to facilitate communication.

- Fill out the direct deposit section by stating your Social Security number and detailing the amount you wish to distribute to your savings and checking accounts.

- Complete the allotment section by specifying amounts to be allocated to loans, IRAs, holiday clubs, or other accounts as necessary.

- Carefully review all information to ensure accuracy, especially regarding account numbers and amounts.

- After completion, you have the option to save your changes, download the form for your records, print a physical copy, or share it as needed.

Start filling out the Payroll Distribution form online today to manage your earnings effectively.

For small businesses, the best way to manage payroll distribution involves selecting an efficient payroll system that automates calculations and payments. Consider leveraging user-friendly software that can accommodate your specific needs without overwhelming complexity. Reliable solutions like uslegalforms often provide templates and guides that streamline the payroll process, facilitating timely and accurate employee payments.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.