Loading

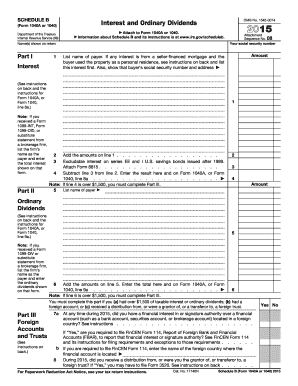

Get 2015 Form 1040a Or 1040 (schedule B). Interest And Ordinary Dividends - Irs Ustreas

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2015 Form 1040A Or 1040 (Schedule B). Interest And Ordinary Dividends - Irs Ustreas online

This guide provides user-friendly instructions to assist individuals in completing the 2015 Form 1040A or 1040 (Schedule B) for reporting interest and ordinary dividends. By following these steps, users can ensure accurate completion of the form while fulfilling their tax obligations.

Follow the steps to fill out the form accurately and efficiently.

- Click 'Get Form' button to obtain the form and open it for completion.

- In the section labeled 'Name(s) shown on return,' enter the names of the individuals completing the form. Ensure accuracy as this will be linked to your tax return.

- Move to Part I and locate line 1 for reporting interest. List each payer’s name and the corresponding amount of interest received. If applicable, include details for seller-financed mortgages according to the instructions.

- Proceed to line 2, where you will total the sums from line 1. Refer to line 3 to report any excludable interest on series EE and I U.S. savings bonds, attaching Form 8815 if necessary.

- For line 4, subtract line 3 from line 2 and enter the result here. If this total exceeds $1,500, complete Part III regarding foreign accounts and trusts.

- Attend to Part II to report ordinary dividends on line 5. Similar to Part I, list each payer and the amounts received as dividends.

- On line 6, total the ordinary dividends listed on line 5. Again, if this total is over $1,500, ensure you address Part III.

- In Part III, respond to the questions regarding foreign accounts. If applicable, indicate whether you had signature authority or a financial interest in foreign accounts during the tax year.

- Finalize the form by reviewing all entries for accuracy. Save the changes to the document, then choose from the options to download, print, or share the completed form as needed.

Begin completing your documents online today to ensure compliance and accuracy.

The 1042 form is used to report income that is subject to withholding for foreign persons or non-resident aliens. This includes payments like interest and dividends that may relate to your investments reported in the 2015 Form 1040A or 1040 (Schedule B). For seamless access to the 1042 form and related resources, turn to US Legal Forms where you can get the help you need.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.