Loading

Get 1 Important Information.docx

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 1 Important Information.docx online

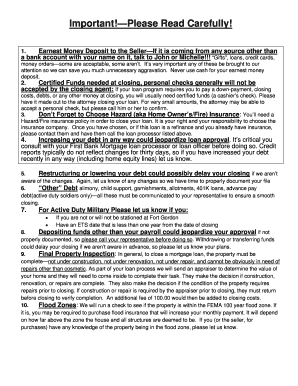

Filling out the 1 Important Information.docx online is a critical step in facilitating your mortgage application process. This guide will provide you with clear, step-by-step instructions to ensure that you successfully complete each section of the document.

Follow the steps to fill out the form accurately and efficiently.

- Click the 'Get Form' button to obtain the document and open it in your editing interface.

- Read through the introduction and instructions carefully to understand the requirements regarding the earnest money deposit. Ensure you document any sources of the deposit and consult with your mortgage representatives if using alternate funding methods.

- Fill out the section regarding certified funds needed at closing. Clearly indicate whether you will be using cashier's checks or personal checks, and confirm this with your attorney beforehand.

- Provide details about your hazard (homeowner's/fire) insurance policy. Choose your insurance company and note down the necessary information in this section.

- Ensure to declare any changes in debt status. Consult with your mortgage loan processor before committing to any additional debt to avoid jeopardizing your loan approval.

- Detail any 'other' debts such as alimony, child support, and any specific financial obligations you need to communicate to your representative.

- If applicable, provide information regarding active duty military status and any conditions related to your stationing or ETS date that may impact your closing.

- Disclose any non-payroll deposits or withdrawals in your bank accounts that may need further documentation to avoid delayed approvals.

- Complete the section on property condition, detailing if there is a need for final property inspections or appraisals prior to closing.

- Fill in the requirements for flood zone checks. Provide any knowledge related to flood insurance requirements and the property’s location.

- If required, submit details regarding termite inspections. Make sure to secure necessary letters if appraisal indicates prior infestations.

- If your closing attorney requests a new survey, indicate any changes to the property that might necessitate this and contact them accordingly.

- Notify your representative about the presence of wells or septic tanks on the property, and include any necessary inspections required.

- For refinances, ensure to document your current title status and any liens on the property for clarity.

- If the property has been vacant for over a year, mention this and potential inspection requirements.

- Indicate any issues or specifications related to mobile homes and clarify the type of home associated with the loan.

- Complete the section regarding the first payment, noting potential loan servicing changes and how to manage your payment after closing.

- Fill in all requested tax information accurately, as discrepancies can cause delays in loan processing. Submit the required addresses associated with your tax returns.

- After filling the form, save your changes, download a copy for your records, and consider printing or sharing the document as needed.

Complete your document online to ensure a smooth mortgage application process.

To have a Copilot summarize a Word document, first ensure that you have the appropriate integration set up. Simply invoke the Copilot and ask it to summarize your document's contents. This feature can save you time, especially with longer documents such as 1 Important Information.docx, making it easier to focus on key insights.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.