Loading

Get Nj 500

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NJ 500 online

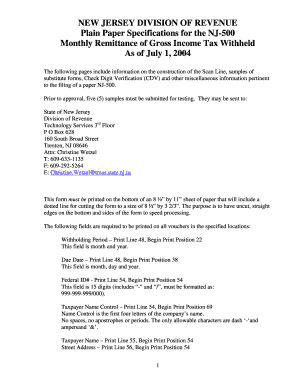

The NJ 500 form is a crucial document for the monthly remittance of gross income tax withheld in New Jersey. Completing this form accurately is essential for compliance with state tax regulations.

Follow the steps to complete the NJ 500 form online.

- Click ‘Get Form’ button to obtain the NJ 500 form and open it in the editor.

- Enter the withholding period in the required format, which is month followed by the year, specifically at Print Line 48, Begin Print Position 22.

- Fill in the due date at Print Line 48, Begin Print Position 38, using the format month, day, and year.

- Input your federal ID number at Print Line 54, Begin Print Position 54, ensuring it consists of 15 digits formatted as: 999-999-999/000.

- Provide the taxpayer name control at Print Line 54, Begin Print Position 69, by using the first four letters of the taxpayer’s name without spaces, apostrophes, or periods.

- Fill in the full taxpayer name at Print Line 55, Begin Print Position 54, followed by the street address at Print Line 56, Begin Print Position 54.

- Complete the city, state, and zip code section at Print Line 57, Begin Print Position 54.

- Add your signature at Print Line 51, Begin Print Position 6, ensuring there is space for the taxpayer's signature. Include the title, date, and telephone number below the signature.

- Write 'REMITTANCE AMOUNT' at Print Line 60, Begin Print Position 65, followed by the amount due at Print Line 62, ensuring it is right justified in position 79 without commas or decimal points.

- Ensure the vendor code assigned by the NACTP is filled in at Print Line 62, Begin Print Position 6.

- Create the scan line at Print Line 63, Begin Print Position 24, ensuring it complies with the specified structure and uses the OCR-A font.

- Confirm all entries are accurate and double-check the formatting requirements.

- Once all information is correctly filled, save the changes, download, print, or share the completed NJ 500 form as needed.

Complete your documents online with ease and stay compliant with state requirements.

Deciding whether to claim 0 or 1 depends on your financial goals. Claiming 0 withholds more from your paycheck and may result in a refund, while claiming 1 reduces your withholding, giving you more funds in every paycheck. Consider your overall tax situation, and if necessary, consult the NJ 500 form for better insights specific to New Jersey regulations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.