Get Substitute Ww-9 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

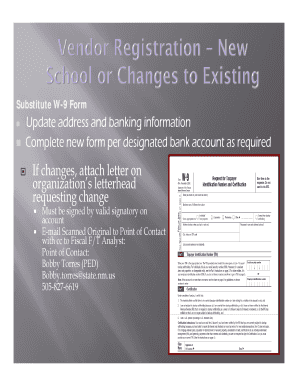

How to fill out the Substitute WW-9 Form online

Filling out the Substitute WW-9 Form online can seem challenging, but this guide will provide you with clear, step-by-step instructions to make the process as smooth as possible. By following these guidelines, you will ensure that your form is completed accurately and efficiently.

Follow the steps to fill out the Substitute WW-9 Form online.

- Click ‘Get Form’ button to obtain the form and open it in your editor.

- Begin by entering your Taxpayer Identification Number (TIN) in the designated section. You can provide either your Social Security Number (SSN) or your Federal Employer Identification Number (FEIN). Ensure that you include only one number.

- Next, fill in your legal name as it is registered with the IRS or SSA. For sole proprietorships, enter your last name, first name, and middle initial.

- If you are doing business under a different name, indicate it in the trade name field. This is applicable for sole proprietorships or businesses operating under a D.B.A.

- Select your business designation by checking the box that accurately describes your entity type, ensuring to answer if you are engaged in providing medical services if applicable.

- Fill out your primary address where correspondence and payment should be sent. This should be your street address or P.O. box along with the city, state, and ZIP code.

- If your remittance address differs from your primary address, complete the remittance address section accordingly, providing the necessary details.

- If applicable, indicate any change of address, marking whether it applies to the remittance or primary address.

- In the certification section, print your name and title, ensuring you understand the penalties for false statements or incorrect information.

- Optionally, if you wish to set up direct deposit, provide your bank name, routing number, and account number, only if you understand the warning about international ACH transactions.

- Finally, review all the entered information for accuracy before proceeding to save your changes, download, print, or share the completed form.

Start filling out your Substitute WW-9 Form online today for a quicker and hassle-free experience.

The W8BEN form is used by non-U.S. individuals to certify their foreign status and claim any beneficial tax rates agreed upon in tax treaties. This form is crucial for ensuring proper withholding tax rates on U.S. income. When submitting a W8BEN, it is equally important to distinguish it from the Substitute WW-9 Form, as each serves a specific purpose depending on your residency status. Ensuring clarity on these forms can simplify your tax reporting process.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.