Loading

Get What Is Thrift Saving Plan

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the What Is Thrift Saving Plan online

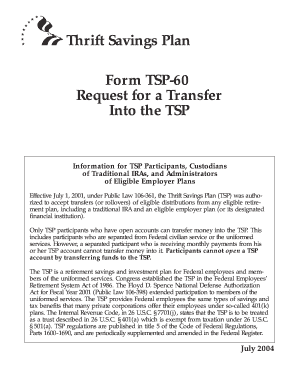

Filling out the Thrift Savings Plan (TSP) transfer request form online can seem daunting, but it is a straightforward process. This guide will provide clear, step-by-step instructions to help you successfully complete the TSP-60 form.

Follow the steps to complete your TSP transfer request form.

- Click ‘Get Form’ button to access the TSP-60 form and open it for editing.

- Begin by completing Section I, which includes your personal information. Enter your name, Social Security number, and address accurately. This information is required for the TSP to identify your account.

- In Section II, select whether your request is for a 'Transfer' or a 'Rollover'. Indicate the amount you wish to transfer into the TSP. If you are using a rollover, provide the date you received the distribution.

- Complete Item 12 by specifying whether the funds are coming from a Traditional IRA or an Eligible Employer Plan.

- In Section III, certify that the information you provided is true. Sign and date the form to validate your request.

- Section IV must be completed by the trustee or administrator of your IRA or employer plan. Ensure they fill out this section with the required details for processing.

- Once the form is complete, ensure it is accompanied by a check made out to the Thrift Savings Plan, showing your name and Social Security number.

- Submit the completed form with the check to the TSP Service Office at the designated mailing address to finalize your transfer request.

Start your online request for the Thrift Savings Plan transfer today!

You can view your thrift savings plan (TSP) balance through the TSP website or mobile app by logging into your account. This platform provides tools and resources to help you keep track of your investments and savings progress. Additionally, you may receive periodic statements that detail your account balance and activity. Regularly checking your balance is important for staying on top of your retirement goals.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.