Get H-5. Model Form For Loans Where Credit Score Is Not Available - Federalreserve

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the H-5. Model Form For Loans Where Credit Score Is Not Available - Federalreserve online

Filling out the H-5 model form for loans where credit score is not available is an essential step in accessing credit options. This guide will provide you with thorough instructions to help you complete the form accurately and effectively.

Follow the steps to complete the H-5 model form online.

- Click 'Get Form' button to acquire the form and open it in your online editor.

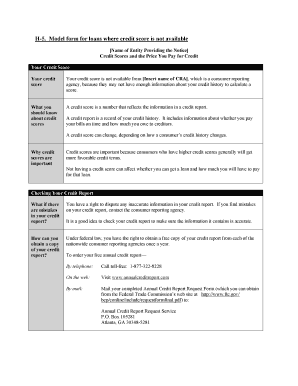

- Begin by filling in the name of the entity providing the notice in the designated field. Ensure this information is accurate as it identifies the source of the loan inquiry.

- In the section titled 'Your Credit Score', include the explanation that your credit score is not available from the named consumer reporting agency. This highlights the reason for using this specific form.

- Next, address the part labeled 'What you should know about credit scores' by summarizing key points about credit scores and credit reports. Emphasize the significance of accurate credit history.

- In the section regarding 'Why credit scores are important', explain its impact on obtaining loans and the terms available, reinforcing that not having a credit score could affect loan approval.

- Proceed to the 'Checking Your Credit Report' section. Provide clear instructions on how individuals can check for inaccuracies in their credit report and the process to dispute any errors.

- For obtaining a copy of the credit report, outline the options available: by telephone, online, and by mail. Include accurate contact numbers and web addresses to ensure users have access to necessary resources.

- Conclude by detailing how users can save, download, print, or share the completed form online to ensure their records are maintained.

Start completing your documents online today for a smoother loan application process.

When your credit score indicates it is unavailable, it usually means that there is not enough information in your credit report to produce a score. New credit users or those who haven’t used credit in a long time often face this issue. In such cases, the H-5. Model Form For Loans Where Credit Score Is Not Available - Federalreserve provides an excellent alternative for securing loans without needing an established credit score.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.