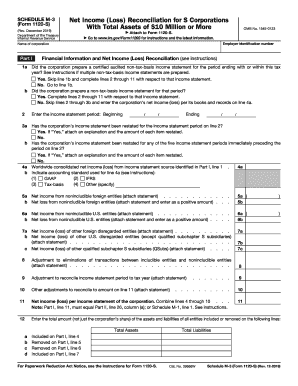

Get Irs 1120s - Schedule M-3 2019-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1120S - Schedule M-3 online

How to fill out and sign IRS 1120S - Schedule M-3 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When you aren’t linked to document management and legal processes, completing IRS forms can be quite overwhelming. We fully understand the significance of accurately finalizing documents.

Our platform provides the answer to simplify the process of submitting IRS forms as effortlessly as possible.

Utilizing our platform can definitely facilitate professional completion of IRS 1120S - Schedule M-3. Ensure everything is arranged for your comfort and efficiency.

- Click the button Get Form to access it and begin editing.

- Complete all necessary fields in your document using our user-friendly PDF editor. Activate the Wizard Tool to streamline the process even further.

- Ensure the accuracy of the information entered.

- Add the completion date for IRS 1120S - Schedule M-3. Utilize the Sign Tool to create a unique signature for document authorization.

- Conclude modifications by selecting Done.

- Send this document straight to the IRS in the most convenient method for you: via email, using digital fax, or postal service.

- You can print it on paper if a hard copy is required and download or save it to your chosen cloud storage.

How to revise Get IRS 1120S - Schedule M-3 2019: personalize forms online

Equip yourself with the appropriate document management resources. Complete Get IRS 1120S - Schedule M-3 2019 with our reliable solution that merges editing and eSignature capabilities.

If you wish to finalize and sign Get IRS 1120S - Schedule M-3 2019 online effortlessly, our web-based solution is the ideal choice. We provide a rich library of template-based forms that you can modify and finalize online. Additionally, there is no need to print the document or resort to external options to render it fillable. All essential features will be conveniently available as soon as you open the document in the editor.

Let’s explore our online editing tools and their primary features. The editor boasts an intuitive interface, allowing you to quickly learn how to navigate it. We’ll examine three key sections that enable you to:

Beyond the functionalities outlined above, you can safeguard your file with a password, add a watermark, transform the document into the necessary format, and much more.

Our editor simplifies the process of altering and certifying the Get IRS 1120S - Schedule M-3 2019. It enables you to do practically everything related to document management. Furthermore, we consistently ensure that your experience in modifying files is secure and adheres to key regulatory standards. All these aspects enhance the enjoyment of using our solution.

Acquire Get IRS 1120S - Schedule M-3 2019, make the essential revisions and adjustments, and download it in your preferred file format. Test it today!

- Alter and comment on the template

- The upper toolbar includes tools that assist you in emphasizing and obscuring text, without images or visual elements (lines, arrows, and checkmarks, etc.), sign, initial, date the document, and more.

- Manage your documents

- Utilize the left toolbar to reorganize the document or remove pages.

- Prepare them for distribution

- If you aim to make the template fillable for others and share it, you can use the tools on the right to insert various fillable fields, signatures, dates, text boxes, etc.

Related links form

Schedule 1 and Schedule 3 serve different purposes on tax forms. Schedule 1 is used to report additional income and adjustments, whereas Schedule 3 reports nonrefundable and refundable credits. Understanding these differences helps taxpayers accurately represent their financial situations on their IRS forms, including the IRS 1120S - Schedule M-3.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.