Loading

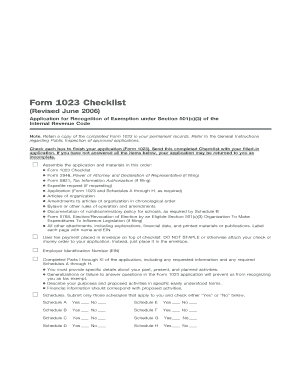

Get Form 1023 Checklist - Internal Revenue Service - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 1023 Checklist - Internal Revenue Service - Irs online

Filling out the Form 1023 Checklist is an essential step in applying for tax-exempt status under Section 501(c)(3) of the Internal Revenue Code. This guide provides clear, step-by-step instructions to help users complete the checklist accurately and efficiently.

Follow the steps to fill out the Form 1023 Checklist online

- Press the ‘Get Form’ button to access the Form 1023 Checklist and open it in your preferred editor.

- Begin by reviewing the checklist items to ensure you have all necessary materials assembled in the specified order.

- Check each box as you complete items on the Form 1023 checklist, ensuring that your application is thorough and addresses all required fields, including the articles of organization and bylaws.

- Provide specific details about your organization’s past, present, and planned activities, as vague responses may lead to an incomplete application.

- If applicable, check the relevant Schedules A through H for your organization and indicate your selections clearly.

- Collect all additional required documents, including a user fee payment and any necessary attachments, and ensure they are properly labeled.

- Review the entire form for accuracy and completeness before submission.

- Once confirmed, save your changes and proceed to download, print, or share the completed form as needed.

Complete your documents online to streamline your application process.

When filing your tax return, include documents that verify your income and deductions. Commonly required documents include W-2 forms, 1099 forms, receipts for expenses, and any documentation related to charitable contributions. Adhering to your Form 1023 Checklist - Internal Revenue Service - Irs will help you ensure that all necessary documentation is ready to support your tax filings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.