Loading

Get Form 8898 (rev. March 2006 ) - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8898 (Rev. March 2006) - IRS online

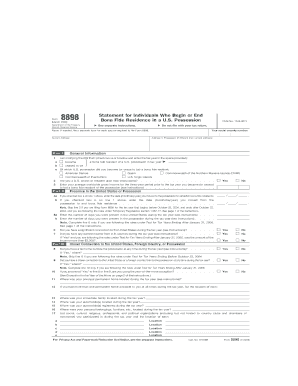

Filling out Form 8898 is an important step for individuals who become or cease to be bona fide residents of a U.S. possession. This guide provides straightforward instructions to help you complete the form accurately and effectively, ensuring compliance with IRS regulations.

Follow the steps to fill out Form 8898 online.

- Click the ‘Get Form’ button to access Form 8898. This will allow you to open the document and begin completing the required fields.

- In Part I, enter your name and Social Security number. If you are married, you must fill out a separate form for your partner as well. Provide your current address.

- Indicate whether you became or ceased to be a bona fide resident of a U.S. possession by checking the appropriate box and entering the tax year.

- Answer the question regarding your U.S. citizenship or residency status by checking 'Yes' or 'No'.

- Provide your average worldwide gross income for the three years preceding the tax year you became or ceased to be a bona fide resident.

- In Part II, fill out the details regarding your presence in the U.S. or possession, including the dates you moved and the number of days spent in each location.

- Answer questions about your connections to the U.S., income sources, and where your personal belongings were located during the tax year.

- In Part III, provide details regarding where you conducted banking activities and any business operations outside of your tax home.

- After reviewing all entries for accuracy, complete the form by signing it and dating it in the designated signature area.

- Once all fields are completed and you have reviewed the form, save your changes, and consider downloading or printing the form for your records.

Complete your Form 8898 online and ensure your residency status is reported accurately to the IRS.

Yes, you can generally access your 1098 form online through your educational institution or financial institution's website. Most institutions provide digital copies of tax forms which you can download directly. If you're having trouble accessing your form, contact the relevant institution for support.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.