Loading

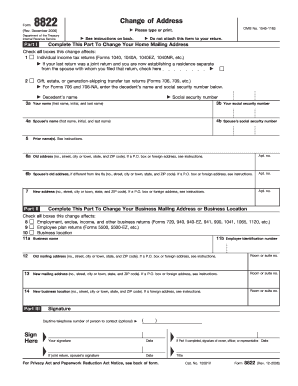

Get Irs Address Change Form 8822

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Address Change Form 8822 online

Filling out the IRS Address Change Form 8822 online can help you keep your tax records up to date. This guide provides straightforward steps to ensure you correctly complete the form to inform the IRS of your new mailing address, whether for personal or business purposes.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred editing tool.

- In Part I, complete your personal details by entering your name as it appears on your tax return, as well as your partner's name if applicable.

- Indicate the type of change by checking the boxes that pertain to your individual income tax returns, or gift and estate tax returns.

- Next, provide your previous mailing address and your partner's address, if they have a different one. Ensure to include any apartment numbers.

- Fill out your new mailing address, again noting any apartment, room, or suite numbers as necessary.

- If applicable, complete Part II by indicating any address changes for your business, including the business name and employer identification number.

- Finally, review your information for accuracy, then save, download, or print the completed form for submission.

Start filling out your IRS Address Change Form 8822 online now.

To notify the IRS about your address change, you need to fill out the IRS Address Change Form 8822 and submit it by mail. Ensure you provide accurate details of your previous and current addresses. This form is the official method the IRS recognizes for processing your change of address. For guidance, uslegalforms can assist you in completing and submitting this vital form effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.