Get Unincorporated Business Tax Return For Individuals

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UNINCORPORATED BUSINESS TAX RETURN FOR INDIVIDUALS online

Completing the Unincorporated Business Tax Return for Individuals is a crucial step for users to ensure compliance with tax obligations. This guide will provide clear and comprehensive instructions to help navigate the online process effectively.

Follow the steps to complete your tax return online easily.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

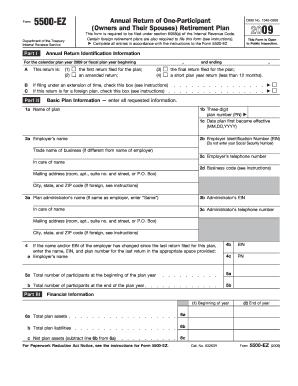

- Begin by entering the basic plan information. Fill in the name of the plan and provide the three-digit plan number. Indicate the date the plan first became effective using the correct format (MM, DD, YYYY).

- Provide the employer's name and Employer Identification Number (EIN). Make sure not to enter your Social Security Number. If there is a trade name for the business, note this as well.

- Complete the contact information for the employer. This includes the employer’s telephone number, mailing address, city, state, and ZIP code.

- If the plan administrator is different from the employer, enter the administrator’s name and EIN. Provide the administrator's contact information and mailing address if necessary.

- Indicate any changes in the employer's name or EIN since the last return by providing the previous details in the specified spaces.

- Enter the total number of participants at the beginning and end of the plan year.

- Proceed to fill in the financial information. This includes total plan assets and liabilities at the beginning and end of the year, ensuring accurate calculations of net assets.

- Report the contributions received from employers, participants, and others during the plan year.

- Answer the compliance and funding questions, indicating if any participant loans were made, and if the plan is a defined benefit or defined contribution plan, providing requisite details as necessary.

- Sign the form by entering your signature, date, and the printed name of the person signing as the employer or plan administrator.

- Review the completed form for accuracy, and once satisfied, save your changes, download, print, or share the form as needed.

Start completing your Unincorporated Business Tax Return online now!

Certain groups and entities qualify for exemption from Tennessee's business tax. For instance, businesses with gross revenue below a specified threshold often do not need to file. Additionally, not-for-profit organizations are generally exempt from this tax, making it important to understand how this can impact your unincorporated business tax return for individuals. Using UsLegalForms can assist you in determining your eligibility for exemptions and ensuring compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.