Loading

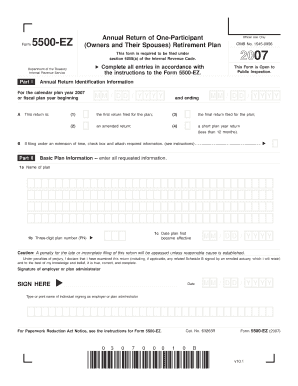

Get 2007 Form 5500-ez - Irs - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2007 Form 5500-EZ - IRS online

The 2007 Form 5500-EZ is a requirement for reporting information regarding one-participant retirement plans. This guide will provide you with a clear, step-by-step approach to accurately complete this form online, ensuring compliance with IRS regulations.

Follow the steps to complete the 5500-EZ form online.

- Press the ‘Get Form’ button to retrieve the form and open it in your document editor.

- Begin by filling out the Annual Return Identification Information section. Enter the calendar year or fiscal year for your plan. Select whether this is the first, final, amended, or short plan year return.

- In Part II, provide the Basic Plan Information. Include the name of the plan, three-digit plan number, and the date the plan first became effective.

- Complete the employer's name and address fields, ensuring to include all relevant details, such as the employer identification number and business code.

- If applicable, enter the administrator’s details. You can indicate 'Same' if the plan administrator is the same as the employer.

- Optional: Fill in any preparer information, including the name and address of the individual or firm completing the form on behalf of the employer.

- Identify the type of plan by checking the appropriate box for defined benefit or defined contribution plans.

- Enter statistics such as the number of qualified pension benefit plans maintained and the number of participants in specified age categories.

- Answer questions related to plan funding, assets, and any transactions between the plan and disqualified persons.

- Complete any remaining sections, review your entries for accuracy, and ensure compliance with IRS regulations.

- After completing the form, save your changes, download, print, or share the form as needed.

Complete your Form 5500-EZ online to ensure timely and accurate filing.

To file the 2007 Form 5500-EZ - IRS - Irs, you can choose to file it electronically or by mail. Prepare your information carefully, making sure to meet all requirements set by the IRS. Platforms like uslegalforms provide excellent resources to make sure your filing goes smoothly and is completed accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.