Loading

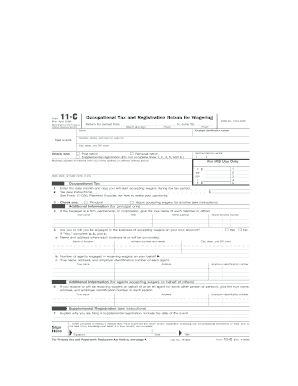

Get Form 11-c (rev. April 2006 ) - Irs - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 11-C (Rev. April 2006) - IRS online

Filling out IRS Form 11-C (Rev. April 2006) is essential for those engaged in wagering activities. This guide provides clear, step-by-step instructions to assist users in accurately completing this form online, ensuring compliance with IRS requirements.

Follow the steps to accurately complete Form 11-C online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out the 'Return for period from' section by entering the starting date and the ending year.

- Provide your name, employer identification number, and business address, ensuring all details are accurate and complete.

- Select whether this is your first return, a renewal return, or a supplemental registration.

- Indicate the date you will start accepting wagers during the tax period in Line 1.

- Determine your occupational tax amount in Line 2, based on your state’s regulations regarding taxability of wagers.

- If you are a principal, provide the necessary information in Lines 4 and 5 regarding your business officers and locations.

- If acting as an agent, fill out Line 6 with the relevant information about the principal you represent.

- If you are submitting a supplemental registration, complete Line 7 explaining the reason for the supplemental filing.

- Sign and date the form, affirming that all provided information is accurate and complete.

- Review the form, then save changes, download, print, or share as needed.

Complete your IRS Form 11-C online to ensure timely and accurate submission.

To obtain an old 1099 form, you can request it from the IRS by filing Form 4506-T. It's important to specify which year you need the form for. The IRS will then mail you a copy, but this process can take several weeks. Alternatively, UsLegalForms offers resources that can guide you through this request efficiently, ensuring you obtain your financial documents when needed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.