Loading

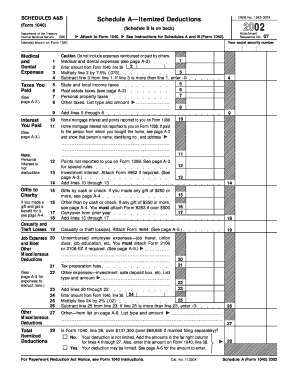

Get 2002 Form 1040 (schedule A&b). Itemized Deductions And Interest & Dividend Income - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2002 Form 1040 (Schedule A and B). Itemized deductions and interest & dividend income - IRS online

Filling out the 2002 Form 1040, including Schedules A and B, can be an important part of managing your taxes. This guide provides a clear, step-by-step process to help users accurately complete the form to claim itemized deductions and report interest and dividend income.

Follow the steps to complete the form accurately and confidently.

- Press the ‘Get Form’ button to access the form and open it in your preferred document editor.

- Fill in your name(s) as shown on Form 1040 and enter your social security number.

- For Schedule A, report your medical and dental expenses on line 1. Carefully check all amounts to ensure accuracy.

- Enter your total income figure from Form 1040, line 36 on line 2 of Schedule A.

- Calculate 7.5% of the amount from line 2 and enter it on line 3.

- Subtract the amount on line 3 from the total medical expenses on line 1 and enter the result.

- For state and local income taxes, list the amounts on lines 5 through 8.

- Proceed to report your mortgage interest on lines 9 through 13.

- For gifts to charity, fill out lines 15 through 18 based on the types of gifts made.

- Add all amounts reported in the far right column for lines 4 through 27 to determine total itemized deductions.

- For Schedule B, report interest income on Part I. Specify the payer names and amounts accordingly.

- Complete Part II for ordinary dividends, ensuring to list only the ordinary dividends received.

- If the total interest or dividends exceed $1,500, complete Part III regarding foreign accounts and trusts.

- Review all entries for accuracy and completeness before finalizing.

- Save your completed document, and consider downloading, printing, or sharing the form as needed.

Start filing your forms online today for a seamless experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Schedule B for interest and dividend income specifically tracks the income you earn through investments, including interest payments and dividends. This schedule complements the 2002 Form 1040 (Schedule A&B) by providing a clear breakdown of such income. Completing it accurately helps ensure that you meet IRS requirements and effectively utilize itemized deductions related to your overall earnings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.