Loading

Get Form 8849 Fillable

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8849 Fillable online

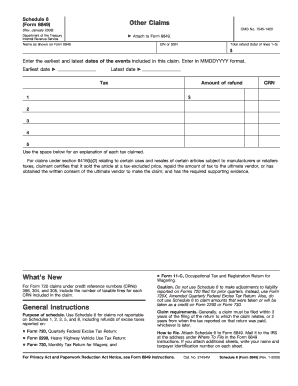

Form 8849, used for claiming refunds of excise taxes, can be filled out conveniently online. This guide provides a clear, step-by-step approach to ensure users complete the form accurately and efficiently.

Follow the steps to fill out the Form 8849 Fillable online

- Press the 'Get Form' button to access the fillable form and open it in your preferred online editor.

- Enter your Employer Identification Number (EIN) or Social Security Number (SSN) in the designated field at the top of the form. This information is essential for processing your claim.

- Input your name as it appears on Form 8849 in the corresponding line. Ensure the spelling is exact to avoid processing delays.

- Calculate and enter the total refund amount you are claiming, which is the sum of the amounts listed in the subsequent lines of the form.

- Provide the earliest and latest dates related to the events included in this claim using the MMDDYYYY format.

- In the following sections, input the tax amounts claimed under the corresponding categories. Each line may refer to different types of taxes, so make sure to follow the instructions provided for each.

- Where applicable, use the space provided to explain each tax claimed. Be thorough in your explanation to support your claims effectively.

- Review all entered information to ensure accuracy and completeness. After confirming that everything is correct, you can save your changes, download the completed form, print it, or share it as necessary.

Complete and submit your documents online to ensure timely processing of your claims.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Form 8949 must be filled out by individuals who sold stocks, bonds, or other capital assets. Taxpayers summarize their gains or losses on this form before transferring the totals to their Schedule D. If you're also filling out Form 8849 fillable, ensure you keep both forms organized for your records.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.