Loading

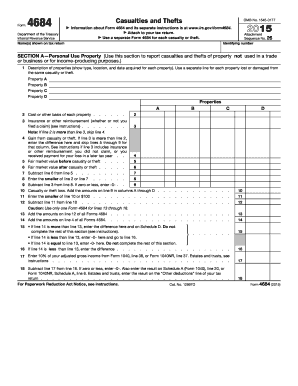

Get Form 4684 Department Of The Treasury Internal Revenue Service Name(s) Shown On Tax Return

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4684 Department Of The Treasury Internal Revenue Service Name(s) Shown On Tax Return online

Filling out Form 4684 is essential for reporting casualities and thefts on your tax return. This comprehensive guide will provide you with the necessary steps to complete the form accurately and efficiently online.

Follow the steps to complete your Form 4684 accurately.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering the names shown on your tax return in the designated field. This ensures that the information is correctly matched with your tax records.

- In Section A, provide detailed descriptions of the properties affected by casualty or theft. Make sure to include the type, location, and date acquired for each property, using a separate line for each.

- For each property, fill in the cost or other basis of the property in the corresponding field. This helps calculate your potential loss accurately.

- Indicate any insurance or other reimbursement you received or expect to receive. This is important as it affects the calculation of your loss.

- Calculate your gain from casualty or theft, if applicable. If your reimbursements are greater than your basis, enter the difference and skip the relevant lines for that column.

- Provide the fair market value of the property before and after the casualty or theft. This information is necessary for determining the extent of your loss.

- Complete the calculations by following the instructions on the form, ensuring you add amounts from the relevant lines as indicated.

- If you are filing for business or income-producing properties, proceed to Section B and repeat the process for any additional properties affected, using separate lines.

- Finish by reviewing all sections of the form for accuracy. Once complete, save your changes, then download, print, or share the form as needed.

Begin filing your Form 4684 online today for accurate reporting of your losses.

IRS Form 4684 is used to report casualty and theft losses to the IRS. If you have experienced a loss due to events like natural disasters or theft, this form helps you document the incident and calculate your deduction. By accurately completing Form 4684, you can claim significant deductions that may lower your overall tax liability. This provides essential support in managing your financial responsibilities.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.