Get Ic134

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ic134 online

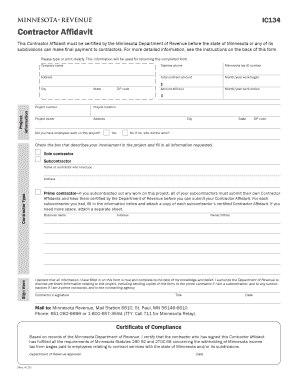

Filling out the Ic134 form is essential for contractors to declare their compliance with Minnesota tax laws. This guide provides step-by-step instructions to assist users in completing the form online accurately and efficiently.

Follow the steps to complete the Ic134 form online.

- Click the ‘Get Form’ button to access the Ic134 form and open it in the editor.

- Begin by entering the company name, daytime phone number, and Minnesota tax ID number in the designated fields. If you do not have employees and completed the work yourself, use your Social Security number instead.

- Fill in your address details, including city, state, and ZIP code, followed by the total contract amount, the month and year when work began, and when it ended.

- Provide project information such as the project number, project location, and project owner’s details, including their address.

- Indicate whether there were employees working on the project by selecting 'Yes' or 'No.' If no, specify who completed the work.

- Affirm the truthfulness of your information by signing in the designated area. Include your title and the date.

- If applicable, fill in the subcontractor information, ensuring each subcontractor submits their own Ic134 form. Attach certified affidavits as necessary.

- Once all sections are completed accurately, review the form to ensure all information is correct.

- Save changes, download, print, or share the completed form as required.

Complete and submit your Ic134 form online to ensure compliance and receive your final payment.

Certain individuals and businesses may qualify for exemption from Minnesota withholding, particularly independent contractors and specific types of organizations. Typically, if an individual earns under a certain threshold or meets specific criteria set by the tax authority, they may not need to have taxes withheld. Understanding these exemptions in connection with Ic134 can help prevent unexpected withholding issues, and using platforms like UsLegalForms can provide clarity on navigating these regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.