Loading

Get 2014 Form 6765 - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2014 Form 6765 - IRS online

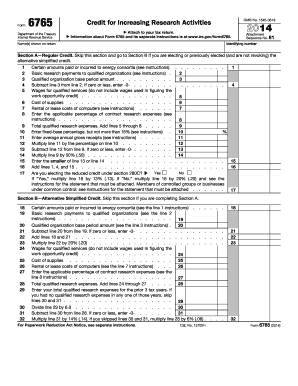

Filling out the 2014 Form 6765 - IRS can be an essential step for users seeking to claim the credit for increasing research activities. This guide will provide clear instructions and step-by-step guidance to help you accurately complete the form online.

Follow the steps to successfully complete the form.

- Press the ‘Get Form’ button to download the form and open it in your editor.

- Begin with Section A if you are applying for the regular credit. If you choose the alternative simplified credit, skip to Section B. Start by entering your identifying number and the name(s) shown on your return.

- In Section A, complete fields 1 to 17 by entering the required amounts based on your research activities, including wages, costs of supplies, and fixed-base percentages. Ensure you follow any specific instructions provided for each line.

- If you are opting for Section B instead, ensure that you complete fields 18 to 34 with relevant amounts for your research expenditures and follow the corresponding instructions for calculations.

- Move to Section C, where you will summarize your credits from previous calculations. Add or subtract the appropriate lines for your final total.

- Review the entire form to ensure all fields are completed accurately and in accordance with IRS guidelines.

- Once you have filled out the form, you can save your changes, download the completed form, print it or share it as needed.

Complete your 2014 Form 6765 - IRS online today to ensure you claim your eligible research credits.

The form 6765 for 2018 is similar to previous versions, designed for taxpayers claiming research tax credits. It helps you report qualified research expenses and claim credits efficiently. If you're looking for guidance on this form, uslegalforms offers resources that can aid you in navigating the 2014 Form 6765 - Irs and its subsequent iterations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.