Get Ira Form Withholding

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

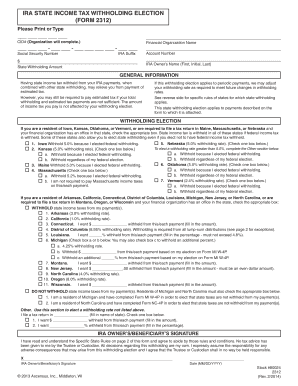

How to fill out the IRA Form Withholding online

Filling out the IRA Form Withholding online can help you manage your state income tax withholding efficiently. This guide provides clear, step-by-step instructions tailored for users of all experience levels, ensuring a smooth completion of the form.

Follow the steps to complete your IRA Form Withholding online

- Click ‘Get Form’ button to obtain the IRA Form Withholding and open it in your preferred editor.

- Enter your CID number, Social Security Number, and IRA suffix in the designated fields.

- Specify the state withholding amount you wish to designate, being mindful of the requirements in your state.

- Fill in your financial organization’s name and your account number accurately.

- Provide your name as the IRA owner in the format of First, Initial, Last.

- Indicate your state of residence and whether you are required to file a tax return in that state by checking the appropriate boxes for state withholding.

- If applicable, choose the appropriate withholding percentage or amount based on your state’s requirements outlined in the form.

- Review your entries for accuracy before moving on.

- Sign and date the form, confirming that you understand the rules and agree to the withholding conditions specified.

- Once completed, save your changes, and utilize the options to download, print, or share the form as needed.

Complete your IRA Form Withholding online today to ensure your tax obligations are managed effectively.

The primary tax form for IRA withholding is Form W-4P, which you complete to specify how much tax to withhold from your IRA distributions. This form allows you to tailor your withholding according to your tax situation, ensuring that you're neither overburdened with taxes owed nor under-withheld. Understanding this form is crucial for effective tax management. For help with this form, uslegalforms is here as a reliable resource.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.