Get Sallie Mae Forbearance Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Sallie Mae Forbearance Form online

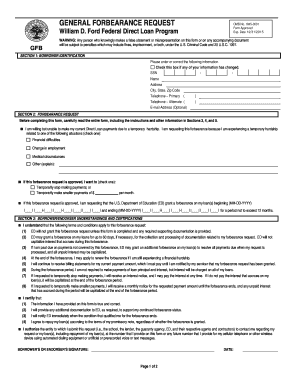

Navigating financial hardships can be challenging, and the Sallie Mae Forbearance Form provides a structured way to request temporary relief from loan payments. This guide will walk you through each section of the form to ensure you can complete it accurately and confidently.

Follow the steps to complete your forbearance request successfully.

- Press the ‘Get Form’ button to access the Sallie Mae Forbearance Form and open it in your preferred editing tool.

- In Section 1, input your personal details such as your Social Security Number, name, address, and contact information. If any of your details have changed, select the appropriate checkbox.

- Move to Section 2 and articulate your reasons for submitting the forbearance request. Select the option that best reflects your situation, such as financial difficulties, employment changes, or medical circumstances. Indicate whether you wish to temporarily stop payments or make smaller monthly payments.

- Specify the start and end dates for your requested forbearance period in Section 2. Ensure these dates follow the MM-DD-YYYY format.

- In Section 3, review the borrower understandings and certifications. Carefully read these conditions to confirm your awareness of your obligations and risks associated with the forbearance.

- Sign and date the form at the designated area in Section 3, certifying that the information provided is true and accurate.

- Consult Section 4 for instructions on how to complete the form accurately. Ensure all supporting documents are included for your request.

- Once you have filled out the form, save your changes. You can then choose to download, print, or share your completed forbearance request, as needed.

Complete your forbearance request online today to manage your loan payments effectively.

To submit a forbearance request, first complete the Sallie Mae Forbearance Form thoroughly. You can then send it via mail or an online portal, depending on your preference and what's available through Sallie Mae. Keep a copy of your submitted form for your records. If you need assistance in navigating the submission process, consider using platforms like uslegalforms, which can guide you in completing and managing your forbearance request effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.